The Prodensa E-Book, "Mexico's Employment Law," provides actionable insights for companies looking to hire employees in Mexico or hire staff in Mexico. Designed for HR professionals and decision-makers navigating the Mexican labor market, the guide addresses legal requirements, cultural context, and strategic considerations vital for successful hiring.

Recent updates to Mexico's federal labor law—particularly since 2019—underscore the need for continuous compliance monitoring and HR expertise when expanding operations. Below is an overview of key topics covered in the e-book.

Labor Compliance for Hiring Employees in Mexico

Key topics of labor compliance for employees in Mexico:

Work Week, Shifts & Overtime

Mexico's legal workweek consists of 48 hours, typically spread over 6 days with 8-hour shifts. Work shifts are classified as:

-

Day Shift: 48 hours/week

-

Mixed Shift: 45 hours/week

-

Night Shift: 42 hours/week

Overtime Compensation:

-

First 9 overtime hours/week: 100% wage premium

-

Additional hours: 200% wage premium

Understanding these distinctions is key to effectively hiring staff in Mexico and planning fair labor schedules.

Holidays in Mexico

Mexico recognizes 9 mandatory federal holidays. If employees work on these days, a 200% wage premium is required. Companies often supplement this with additional leave tied to regional, cultural, or company-specific observances—critical for employee satisfaction and retention.

Observing social and cultural events also helps foreign companies integrate into the local workforce and improve employee morale.

Employment Labor Agreements

When you hire employees in Mexico, choosing the right contract type is essential:

-

Indefinite Contracts: Offer long-term stability without a fixed end date.

-

Definite Contracts: Time-bound and used for seasonal or trial employment.

Termination Terms:

-

3-month severance salary

-

Seniority premium (12 days per year for long-term employees)

-

Pro-rated benefits (Christmas bonus, vacation days, etc.)

Payroll & Benefits

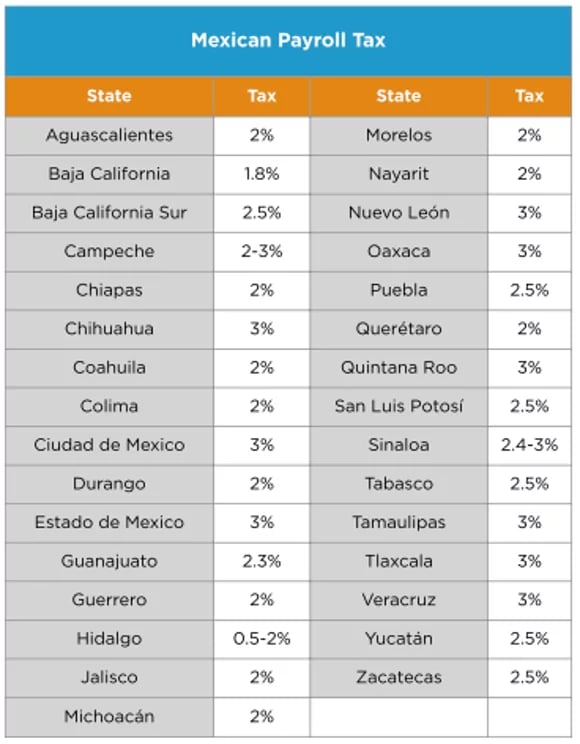

Mexican payroll is typically biweekly for salaried staff and weekly for hourly workers. Payroll tax rates vary by state.

Key Cost Considerations:

-

Minimum wage is adjusted annually

-

Benefits range from 28% to 100% of base salary, including:

-

Christmas bonus

-

Paid holidays

-

Vacation premium

-

Profit-sharing

-

Employees must also be registered with Mexico's social security system, which provides access to healthcare, housing, childcare, and retirement benefits.

In high-turnover industries, understanding compensation strategies and legal obligations can significantly enhance retention and reduce onboarding costs.

Labor Reform 2019: A New Legal Framework

The 2019 labor reform brought transformational changes to Mexican employment law, including:

-

Transferring labor court jurisdiction from the executive to the judiciary

-

Establishing independent labor conciliation centers

-

Strengthening freedom of association and collective bEmployment Labor Agreements

Conclusion: Hiring in Mexico a Viable Path to Expansion

Expanding your operations and building a capable team starts with a strong foundation in local labor compliance. Whether you're just beginning your journey or optimizing an existing workforce, knowing how to hire staff in Mexico with accuracy and confidence is critical to success. With ongoing labor reforms and regional complexities, partnering with experienced advisors like Prodensa ensures your hiring practices are compliant, competitive, and aligned with your business goals.

Get Expert Guidance

Understanding how to hire employees in Mexico legally and effectively can mean the difference between operational success and compliance risk. For personalized support and access to our full E-Book, contact Prodensa today.

Request a Proposal for your next hiring project in Mexico, and get the flexible support you need--from turnkey operations models to tailor-made support.