The Mexican government’s announcement in the Official Gazette (DOF) on November 19, 2025, marks a structural shift in the country’s foreign trade regulatory framework. This sweeping reform to Mexico's Customs Law will come into effect on January 1, 2026, introducing a digital, predictive, and continuous supervision model for customs operations.

For manufacturing executives, foreign investors, and supply chain leaders, understanding this transformation is critical. Mexico is transitioning to a system of remote oversight and early intervention, and failure to adapt could lead to operational disruptions and financial penalties.

Here’s a breakdown of the reform’s most critical changes—and how to prepare.

1. A Digital Customs Framework Backed by Legal Redefinition

The core of the reform is the creation of a technologically integrated customs system, giving the authorities explicit powers to collaborate with Mexico’s Digital Transformation Agency and leverage big data analytics.

Customs Regime Reclassification

The reform formally incorporates the definition of a "customs regime" into the Law. This concept is no longer just an operational reference; it is now the legal destination that strictly determines the treatment, obligations, and restrictions that apply to goods.

Direct implication: Your company should internally review the customs regimes currently used in its operations. Correct regime assignment is now the binding basis for any compliance audit and for tax optimization.

In addition, to operate under specific authorizations—such as customs clearance at a place other than the authorized facility, bonded warehouses, or strategic bonded facilities—the Law now requires a technological system that integrates:

-

Permanent, automated inventory control

-

Continuous monitoring and security

-

Real-time traceability and tracking

-

Remote access for the SAT

If your company acts as a concessionaire, you must also factor in payment of a fee equivalent to 5% of revenues.

In practice, this means you now need to adapt your IT infrastructure to allow the interoperability and remote access that the authority will require in order to keep your authorizations in force.

2. Document Traceability and the New Electronic Customs File

The reform raises the standard for documentary evidence. The electronic customs file is no longer just a repository of customs entries; it becomes a detailed accounting and financial log.

Financial and Operational Integration

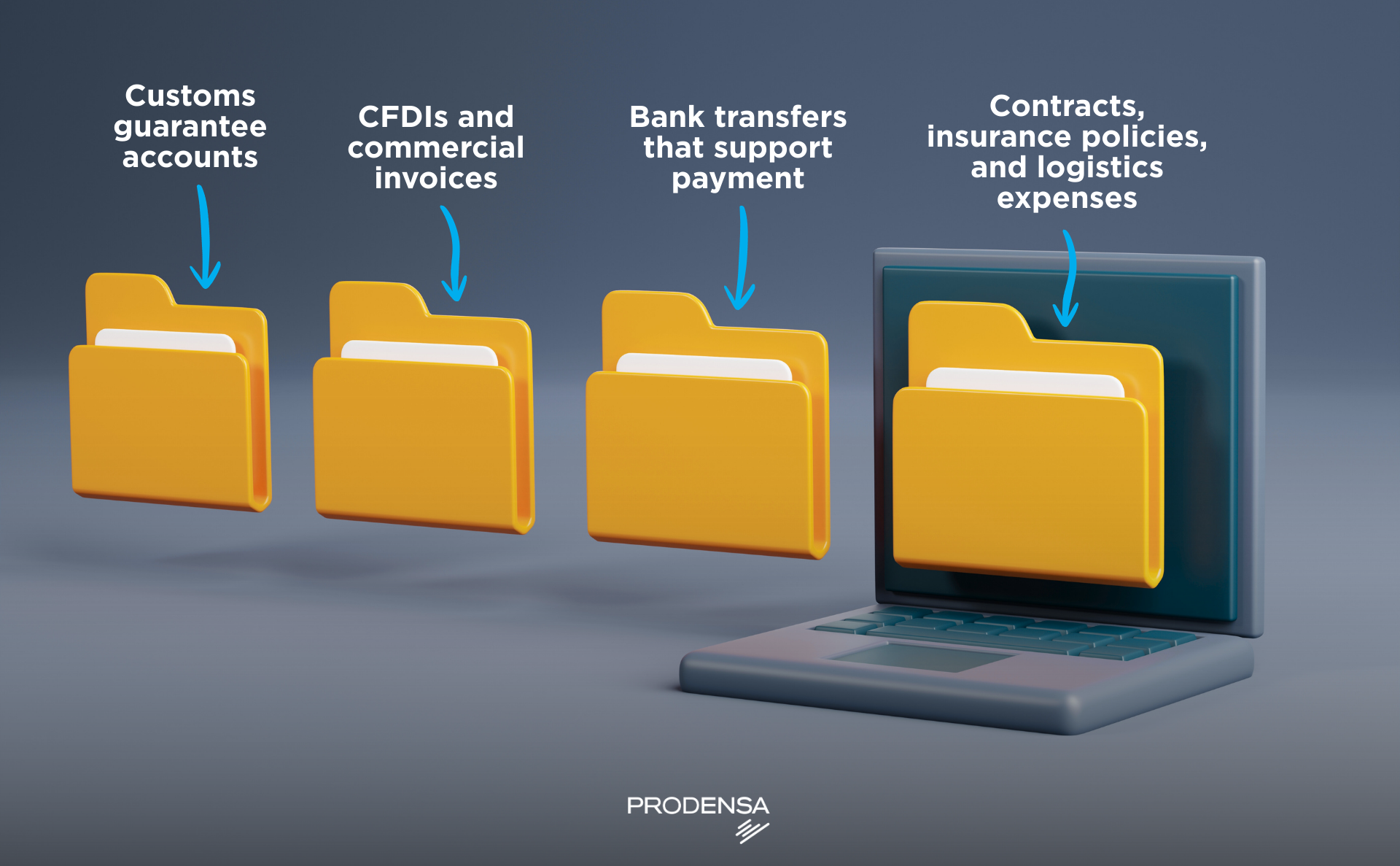

Your electronic customs file must now include detailed information on all resources and documents involved in the operation, including:

This integration is designed to close the gap between the physical flow of goods and the financial flow behind them. The tax authority may use video recordings and other technological tools as evidence for tax verification.

Control in International Transits

There is also a new and important obligation for complex supply chains: when goods transit through countries that are not part of a preferential trade agreement, companies must prove that they have remained under customs control in order to apply preferential tariffs.

-

Required action: You should strengthen documentation across your international logistics chains. If you cannot prove that the goods were not altered during transit, you will lose access to preferential tariff benefits.

3. Critical adjustments to operating times

The reform modifies timelines that directly affect logistics planning and compliance. Your customs team will need to adjust its operational calendars starting in 2026.

Consolidated Pedimentos

The transmission frequency is changing. Consolidated pedimentos must now be submitted no later than each Friday, covering operations for the week (Monday to Sunday), eliminating the previous Tuesday deadline. This requires a faster, error-free weekly administrative closing.

Bonded Warehouse and Storage

Stricter rules now apply to bonded warehousing:

-

Entry deadline: You have a maximum of 20 calendar days (counted from the conclusion of customs clearance) to move the goods into the general bonded warehouse.

-

Consequences: If you do not meet this deadline, you must change the customs regime, pay the corresponding duties, and comply with applicable non-tariff regulations.

-

Discrepancy report: The deadline to report shortages or surpluses to the SAT is reduced to 24 hours after arrival.

Temporary Import and IMMEX Program

For IMMEX companies, the 60-calendar-day period to return temporarily imported goods or change their regime in the event of program cancellation is now elevated to the level of Law. Failure to comply with this return generates immediate tax credits. Additionally, the permitted stay for boats and recreational vehicles under temporary importation is reduced from 10 to 5 years.

4. Operational Timelines Are Tighter—Act Now

The decree broadens the legal liability of all actors involved in customs clearance, removing previous protections and increasing your company’s tax exposure.

Joint Liability for Temporary Transfers

Joint liability for the payment of taxes now applies to transfers of temporarily imported goods, regardless of how many times the goods are transferred. This means that in virtual operations or transfers between companies, the tax risk remains active throughout the entire supply chain.

New Regulatory Framework for Customs Brokers and Agencies

The role of customs brokers is now subject to stricter regulation:

This fundamentally changes the dynamic between importers and brokers: brokers now have a legal incentive to take a more conservative and rigorous approach in validating your operations.

5. System of Sanctions and Penalties

Failure to comply with the new provisions carries severe financial penalties designed to drive adoption of the new model.

-

Courier companies: Fines ranging from MXN 800,000 to 1,000,000 for failure to comply with simplified clearance requirements.

-

Unauthorized clearance locations: Fines between MXN 1,500,000 and 2,000,000 for failure to comply with formal clearance procedures.

-

Bonded warehousing: Penalty of 70% to 100% of the customs value if goods are not presented within the required timeframe.

-

Precautionary seizures: New grounds added, such as inability to locate temporarily imported goods or failure to comply with NOMs related to commercial information.

6. Compliance Strategy: Four Key Actions

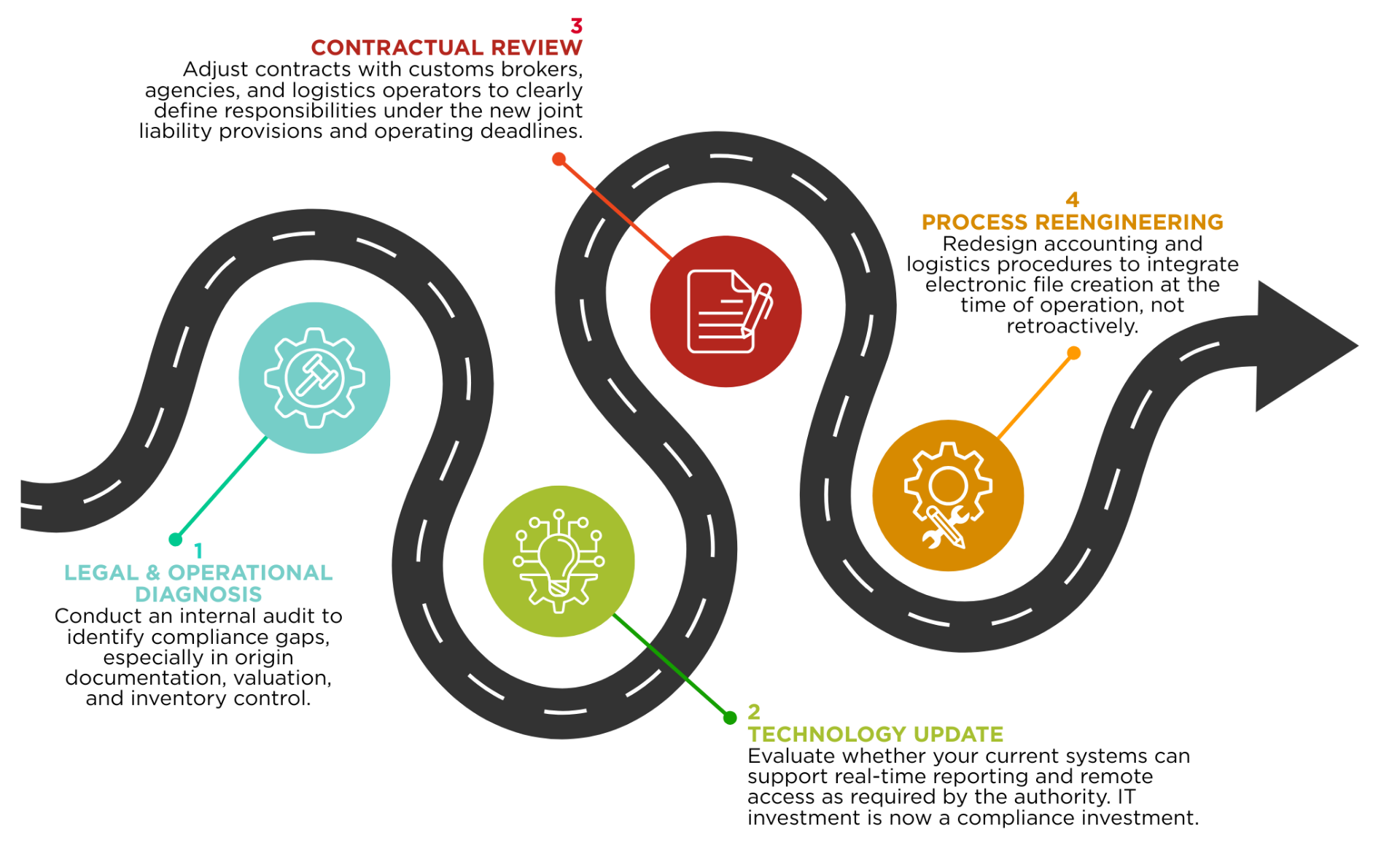

In this new environment of preventive oversight and total traceability, your company must act decisively to comply. At Prodensa, we recommend a roadmap based on four pillars:

The 2026 customs reform establishes a high-tech compliance environment where the ability to prove compliance in real time will be critical for operational continuity. The authority now has both the legal framework and the technological infrastructure to monitor every link in the supply chain.

PRODENSA Key Takeaways:

PRODENSA Key Takeaways:

-

The new customs regime classification makes accurate regime assignment a legal requirement for audits and tax optimization.

-

Automated inventory tracking, remote SAT access, and real-time traceability are now mandatory for companies with customs authorizations.

-

The electronic customs file must include detailed financial and operational documents to ensure compliance and prevent penalties.

-

Companies must prove that goods remained under customs control when transiting through non-trade-agreement countries.

-

IMMEX and bonded warehouse timelines are now strictly enforced and codified into law—noncompliance triggers immediate tax exposure.

-

Customs brokers are subject to higher liability and must verify client compliance, altering importer–broker relationships.

-

Failure to adapt to the new customs framework will result in substantial penalties, ranging from six-figure fines to loss of preferential treatment.

-

Proactive steps—diagnostics, IT upgrades, contract reviews, and process integration—are essential for seamless compliance in 2026.