Trade and Mexico are at a crossroads. The manufacturing sector in Mexico is experiencing a period of significant evolution, driven by a complex web of geopolitical, economic, and social factors.

Prodensa CEO, Emilio Cadena and President, Marco Kuljacha

At Prodensa, our commitment to providing forward-thinking solutions and insights for manufacturing executives has never been more crucial. In the wake of our 1Q 2024 strategy forum, we’ve distilled key industry trends that are shaping Mexico’s manufacturing landscape and the strategic responses they necessitate.

Geopolitical Influences and the Shift in Globalization

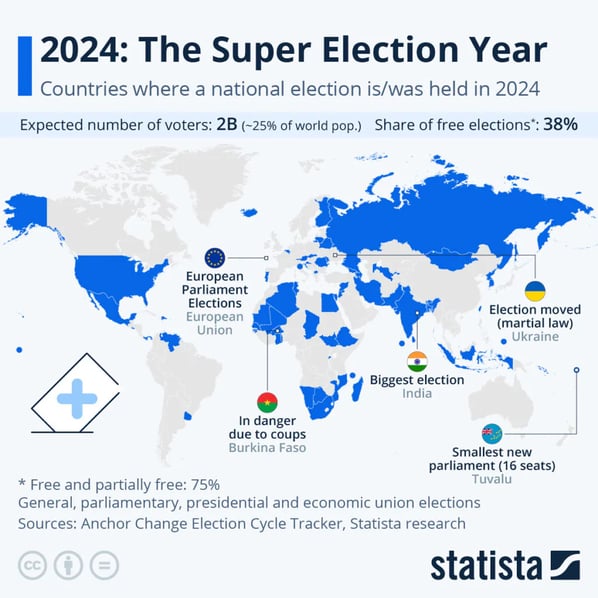

2024 is not just an election year; it’s perhaps the election year. Globally, more voters than ever in history will head to the polls as at least 64 countries (plus the European Union) – representing a combined population of about 49% of the people of the world – are meant to hold national elections.

Recent geopolitical events, notably the ongoing conflict in Ukraine, have accelerated shifts in the global economic landscape. The reconfiguration of trade relationships between powerhouses like the United States, China, and Mexico underscores the need for agility and foresight in navigating these changes.

Meanwhile, Prodensa will be closely watching how the United States advances on their relationship with China, and keeping an eye out for India.

“One billion people live in India and from my geopolitical point-of-view, this is key. They will maintain a growing population moving forward. This could result in a new type of relationship with the United States in this part of the world. But politics is most likely to shape India’s foreign policy, so we are still just speculating.

Even still, the 2024 election in the United States will be more critical to determine what could be in store for Mexico in this new era of trade.”

Emilio Cadena, CEO

Rising tensions between major powers and a focus on national security are reshaping global trade patterns, leading companies to re-evaluate supply chains and consider nearshoring opportunities. This shift in globalization creates both challenges and opportunities for businesses seeking to navigate the evolving geopolitical landscape. Prodensa is keeping a close watch on the global elections of 2024.

Mexico Trade Program: IMMEX

At the height of the reshoring and nearshoring boom in North America, Mexico’s business environment is under the spotlight. Politics have also shifted dynamics in Mexico, and some long-standing programs could see some changes. Amidst discussions of potential reforms to the IMMEX regime—and, the increased compliance requirements of the fiscal authorities–Mexico’s competitive edge hangs in the balance. The IMMEX Program allows manufacturers to import machinery and materials without paying a 16% value-added tax. Thus Mexico could be at a big disadvantage without it.

In recent years Prodensa has seen increased audits stemming from stricter compliance enforcement. This has dramatically increased the administrative burden on international trade operations for cross-border manufacturers in Mexico.

“The Mexican fiscal authority (“SAT”) has gotten more sophisticated and the industry has been accustomed for decades to operate differently, more freely. Today, it is no longer possible for manufacturers to manipulate systems to report what SAT is requiring, like maybe some had been doing before. That inertia of doing things comfortably in error because it is the “most practical option” has brought many risks to the industry, and we are feeling those consequences. Almost every day we are seeing a company lose their importation permits, costing them lots of time, cash flow and frustration.

This type of sudden increase in audits and compliance standards is probably tied to the United States. As the biggest consumer market, they often dictate the rules. Increasingly, they want to know where things come from, and Mexico, being the biggest trading partner to the United States, needs to verify that.”

Marco Kuljacha, President

The world is shifting to a place where there is greater government scrutiny and intervention in foreign trade. It is not longer a “free market” as it was once considered. The complexities of global trade demand enhanced collaboration between the private sector and government bodies, a partnership that will define Mexico’s international trade trajectory. Prodensa’s team is working at this exact intersection, to bring more transparency and understanding to both parties.

Read more Prodensa Insights: Mexico Outlook 2024.

Labor Reforms in Mexico

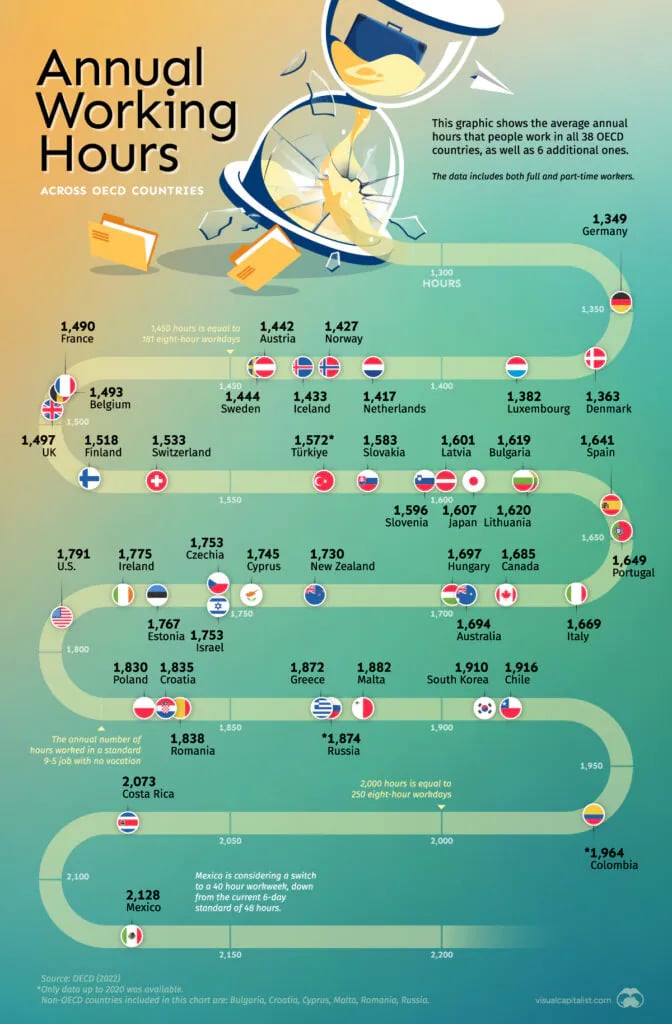

Recently, a bill to reduce the work week in Mexico has garnered support. Currently, Mexico is the OECD countries with the highest average working hours. The initiative intends to implement a mandatory rest of 2 days per every 5 days of work. Thus reducing the work week from 48 to 40 hours for full-time labor. This is on par with many other countries in the world.

As Mexico is rightfully touted for its strength in workforce availability and cost, this bill could drastically change the investment landscape, as well as the compliance of so many that operate businesses in Mexico today.

“The [Mexican] President knows this is a big challenge for the installed capacity and for the government. It would immediately increase operative costs, and its not clear how that would be funded. Moreover, in terms of employee complaints, the work week has not been one of the primary ones. This seems to be more of a political topic for the moment, yet it’s something where we are monitoring closely and advocating for the private sector.” – Emilio Cadena, CEO

Follow Prodensa’s VP of Human Resources, Alvaro Garcia, on LinkedIn for additional insights.

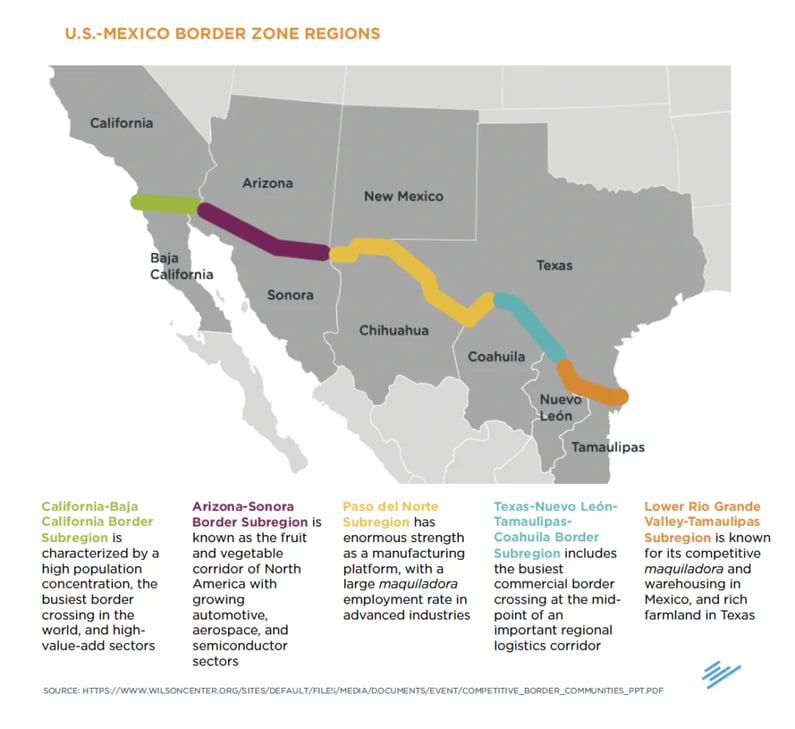

US-Mexico Border Security

Meanwhile, logistical efficiency and border security remain peripheral concerns. On the US-side of the border, the President is in a position of reelection and the border has become a key topic. It seems very likely the border with Mexico will close at some point before the U.S. elections in November. This could mirror pandemic-era supply issues that affect daily life on both sides of the border.

“With the US-Mexico Foundation, CCE and CEO Dialogue, we are working on a proposal to maintain a part of the border infrastructure open for essential industries, like during the pandemic. It’s possible we could agree to leave open certain key, border cities. The essential industries cannot stop their flow of production and transport. The supply chains between the United States and Mexico are so intertwined; it would be a recipe for disaster.”

Emilio Cadena, CEO

Seizing Opportunities Amidst Challenges

Nearshoring will continue to be the trend over the next years. Shifts in globalization trends and changing dynamics with U.S. trading partners will bring new opportunities. Mexico has a great geographical advantage, evidenced by the increase in trade exports to the United States.

The electric automotive industry emerges as a big opportunity for Mexico, symbolizing a junction of innovation, investment, and environmental stewardship. Accordingly, Mexico is the 2nd largest exporter of autos (and 1st in auto parts) to the United States market. Their current posture toward Chinese auto suggests that Mexico will probably be a top exporter of electric autos to the United States as well. The supply chain is already undergoing a transition in Mexico.

In 2023, more than 100,000 EV vehicles were produced by companies such as: Ford, General Motors, BMW Group, Audi, Giant Motors, Toyota. In the same year, nearly 100 investments were announced in the electromobility sector in Mexico.

Download the Automotive Industry in Mexico E-book.

The biggest challenge for Mexico is infrastructure, and the current administration is very slow. Consequently, the key to new infrastructure development is in the hands of the government, not private companies. This is very apparent in today’s administration with a lack of clear strategy for the nearshoring opportunity laying in front of us.

“In Mexico, over the past 2 years we have increased almost 50% in exports, to $460 billion dollars. Yet there is not 50% more infrastructure development – power lines, border-crossing lanes, customs or CBP agents, water treatment, etc. This is why Mexico’s infrastructure will be a central challenge in the short-term.”

Emilio Cadena, CEO

Mexico’s robust manufacturing sector and growing role in nearshoring highlight the need for continued infrastructure development. Upgrading transportation networks, ports, and energy grids will be crucial for ensuring efficient operations and maintaining Mexico’s competitiveness in the global market.

Conclusion

Despite these challenges, Mexican labor remains a formidable asset, and is marked by competitive wages with room for growth, aligning with global standards for decent work and economic growth.

The Mexico Outlook 2024 is a highlight of the Executive Advisory practice by Prodensa, serving companies in Mexico with their institutional relations strategy.