The Mexican Automotive Industry Report provides an overview of the transition of the industry to electromobility preparedness. Over the last several decades, the automotive industry in Mexico has emerged as a significant player on the global stage. Today, it plays a pivotal role in the world economy. With a strategic location, skilled workforce, and a favorable business environment, Mexico has become a key hub for automotive manufacturing.

Mexican Automotive Industry

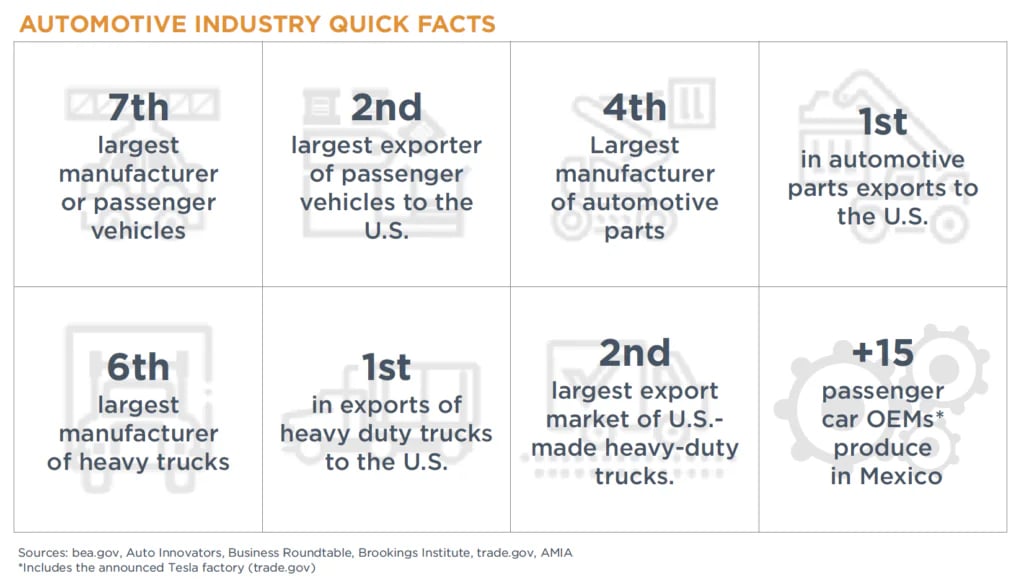

Mexico’s trade liberalization efforts mean that the market is one of the most open and competitive in the world. Mexico is a global leader in automotive manufacturing.

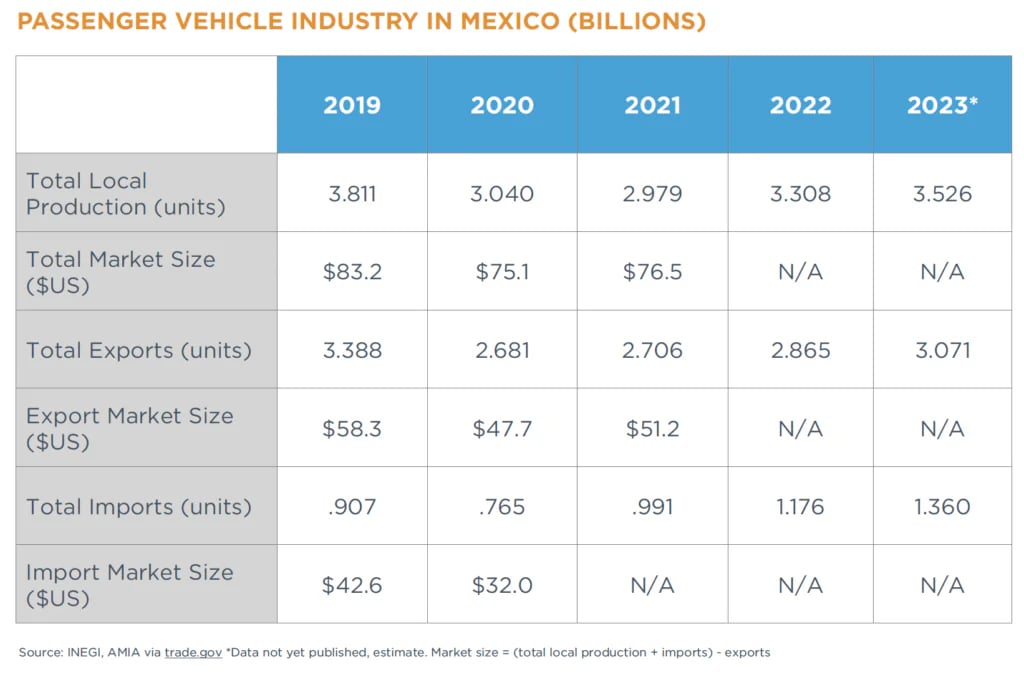

Mexico is a key ally and asset to the U.S.-based high-technology manufacturing including semiconductors and electric vehicles. The Mexican Automotive Industry Association (AMIA) estimates that Mexico will become the 5th largest global vehicle producer by 2025. The industry employs over 1 million professionals, including 300 R&D Centers. Of total automobile production, 87% is exported. Over 79% of those exports are destined for the U.S. marketplace.

Mexico is the 4th largest vehicle exporter globally after Germany, Japan and the United States. Over 95% of the automotive production in Mexico is light (passenger) vehicles and the rest is heavy trucks.

The Mexican Automotive Report includes insights from Prodensa VP & Sr. Partner, Carlos Alvarado, on the evolution of the industry and the transition to electromobility.

Mexican Automotive Supply Chain

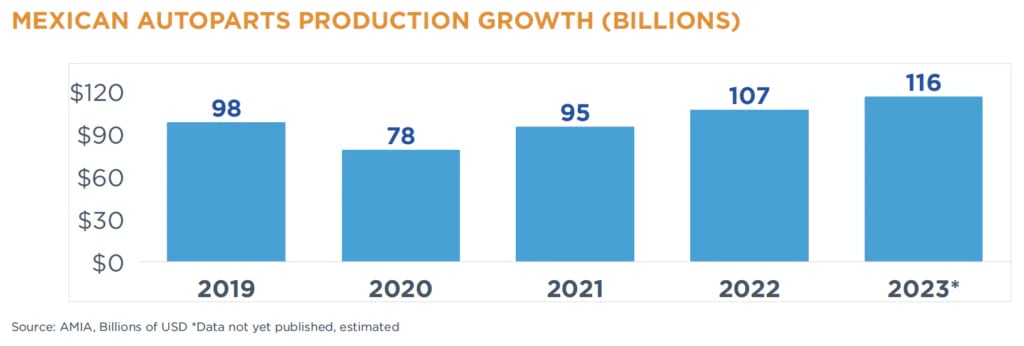

Mexico is the 4th largest producer of autoparts in the world, and 1st to the United States. More than half of the imported autoparts to Mexico compliment the local manufacturing lines. Much of this is then exported back to its original country. The primary countries of origin include the United States, China, Germany and Japan.

Suppliers are pivoting to electric engines, which lack integral parts of an internal combustion vehicle such as gas tanks, exhaust valves, transmissions, fuel pumps, carburetors. One of the biggest challenges for Mexico will be batteries, electronics and electrical motors. Today, much of this content is brought from China for final assembly in Mexico. Additionally, new market opportunities emerge with the needs of new weight and efficiency requirements of EVs.

Major U.S. automotive companies have invested significantly in the Mexican automotive industry, enhancing cost-effectiveness and maintaining competitiveness in the global market. Established automakers in Mexico include: Audi, BMW, Ford Motor Company, General Motors, Honda, Hyundai, Jac by Giant Motors, Kia, Mazda, Mercedes Benz, Nissan; Stellantis, Toyota, Volkswagen, and Tesla (announced). In addition to major OEM’s, the automotive industry in Mexico boasts a robust and intricate supplier base.

Several Chinese suppliers have recently established a presence in Mexico, taking advantage of the country’s strategic location and the North American market. Some Chinese automakers with operations or plans to operate in Mexico include BYD Auto Co., Ltd., JAC Motors, Great Wall Motors, and Geely.

Automotive Manufacturing Clusters

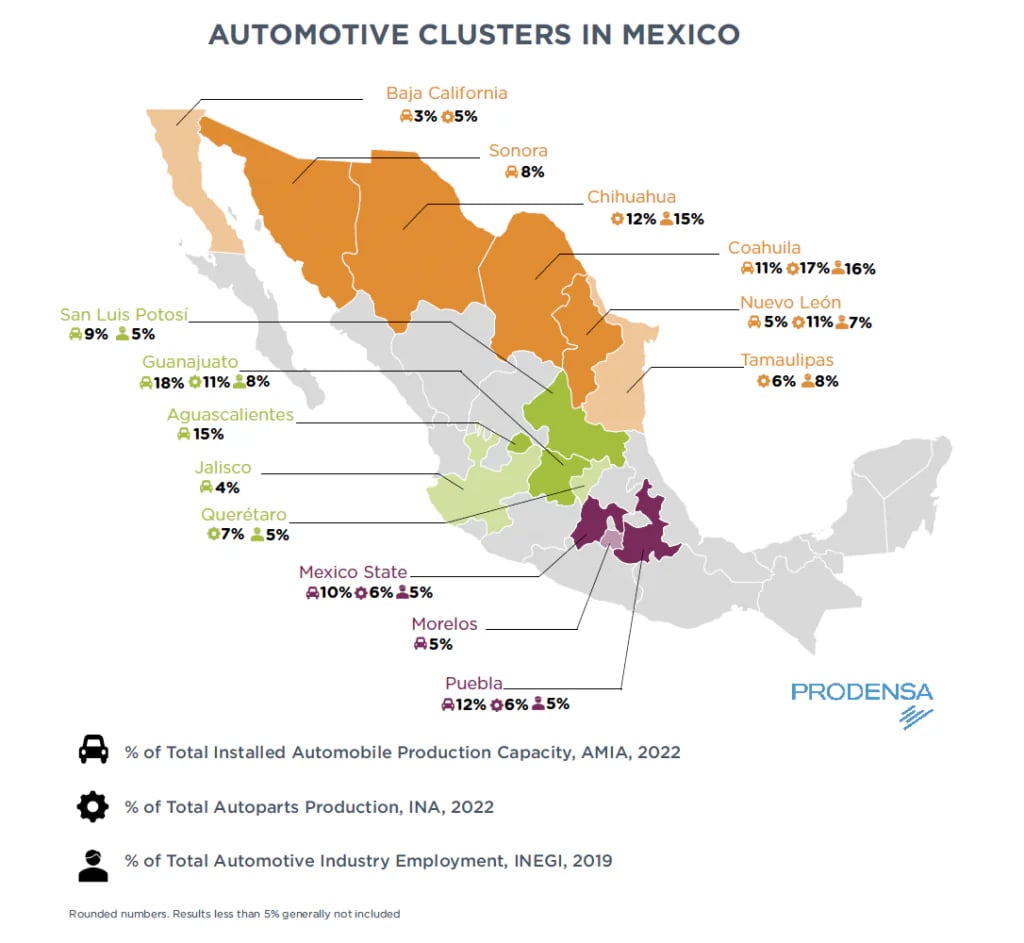

Automotive companies are located all over Mexico. Clusters promote joint efforts to develop more extensive local supply chains for the industry. For this map, clusters signify the highest percentage of installed production capacity, autoparts production, and industry employment.

The Bajio Region

The Bajío region is often referenced as the 3rd most important automotive cluster in North America. It represents nearly 50% of all vehicle production capacity in the country. Other supporting states in this cluster include Jalisco (Honda) and Querétaro, home to many Tier 1 suppliers.

Aguascalientes – The central Mexican state of Aguascalientes is home to one of the country’s most important assembly plants, Nissan. It is the 3rd largest exporter of vehicles in Mexico. About 20,000 workers in 35 Tier 1 plants supply this campus. Automotive manufacturing represents 85% of the state’s manufacturing exports.

Guanajuato –The state of Guanajuato in Bajío is an important automotive and logistics hub. General Motors, Volkswagen, Mazda, Honda and well over 400 Tier 1 & 2 autoparts supplier make up Guanajuato’s automotive cluster. The automotive industry makes up about 50% of the state’s manufacturing GDP, and 80% of the state’s total exports. It employs over 145,000 workers.

San Luis Potosi – The automotive industry in San Luis Potosí generates 85,000 jobs in the state. It is home to General Motors and BMW Group, and about 240 automotive suppliers. San Luis Potosí’s automotive industry exports about $10 billion in manufactured goods each year.

The Northern Border States

The northern border states of Mexico represent over half of all autoparts production, a large share of them being maquiladoras. Notably within the cluster, Baja California is home to a Toyota plant in Tijuana. In the Gulf state of Tamaulipas, the city of Reynosa is an important autoparts maquiladora and logistics hub.

Sonora – This northern border state’s primary industry is automotive manufacturing. The Ford Stamping and Assembly Plant in Hermosillo has developed over 45 local suppliers, and their engineering center enrolls over 1,000 students. Notably, the state’s Port of Guaymas is on the Pacific coast. Nearly 28% of the state’s exports come from the automotive industry. This is growing due to Ford’s production of the new models, Maverick and Bronco Sport.

Chihuahua – The northern border state of Chihuahua has a robust automotive presence, including Ford Engine Plant and more than 400 suppliers. The state is well-known for automotive talent development, boasting 6 R&D centers. The automotive sector represents over 40% of the total manufacturing industry in the state. The border city of Juarez is a focal point of the maquiladora industry due to its location and infrastructure.

Coahuila – The automotive sector represents more than half of the northern border state’s manufacturing production. It is home to Stellantis, Daimler Freightliner and General Motors. In fact, GM announced a $1 billion e-mobility investment in its plant in the state. Coahuila has been a focal point of automotive investment in Mexico over the last years. Automotive exports in the state are around $5 billion, representing about 67% of the state’s total exports.

Nuevo Leon – The northern state of Nuevo León is the electromobility hub of Mexico. Home to KIA and a number of Tier 1 suppliers, the automotive industry in the state is the top employer and top exporting sector. Tesla announced a $5 billion dollar investment in their new Gigafactory in Nuevo León. The state boasts other important automotive operations such as Navistar (heavy trucks); Mercedes-Benz Group (buses); Polaris, CF Moto and Kawasaki (ATVs). Automotive exports in 2022 were $12 billion and officials are projecting growth.

Central Mexican Valley

The valley in Central Mexico around the capital of Mexico City concentrates about a quarter of the country’s total population. It is an important logistics and e-commerce hub, among other things. The automotive industry is important, both as corporate headquarters in Mexico City, but also to multiple manufacturing hubs in the surrounding states. Morelos, another state in the cluster, produces about 5% of the country’s vehicles at their Nissan plant.

Mexico State – The automotive industry in Mexico State represents over 12% of GDP for the state. Three OEMs call the state home (Stellantis, General Motors, Ford) as well as more than 350 automotive companies that employ over 50,000 workers. The state is also home to automotive plants with announced investment in electric vehicles, including Ford and Stellantis. Mexico State exports over $6 billion in automotive goods with nearly a quarter of that in vehicles.

Puebla – The Central Mexican state of Puebla is home to Volkswagen and Audi. Over 65,000 employees in the state work in the automotive industry. The industry represents over 40% of the state’s GDP. Puebla is one of the top exporters of automobiles, with the majority share of their auto exports going to the United States, Germany or Canada.

Regional Collaboration

Mexico has become a crucial partner for U.S. and Canadian automakers, providing a cost-effective and efficient manufacturing base and plentiful labor pool. The integrated supply chains between the three countries are vital for the competitiveness of North American automakers in the global market.

The United States, Canada and Mexico share a population of +500 million people, a GDP of nearly US$30 trillion dollars, and each alone are important, global economies. One of every 13 jobs in the U.S. is supported by trade with Canada or Mexico. In fact, about 50% of trade within North America occurs in “intermediate goods” – materials or components destined for final assembly within the same region.

The three countries literally build things together, and millions of jobs depend on that.

North America Electric Vehicle Industry

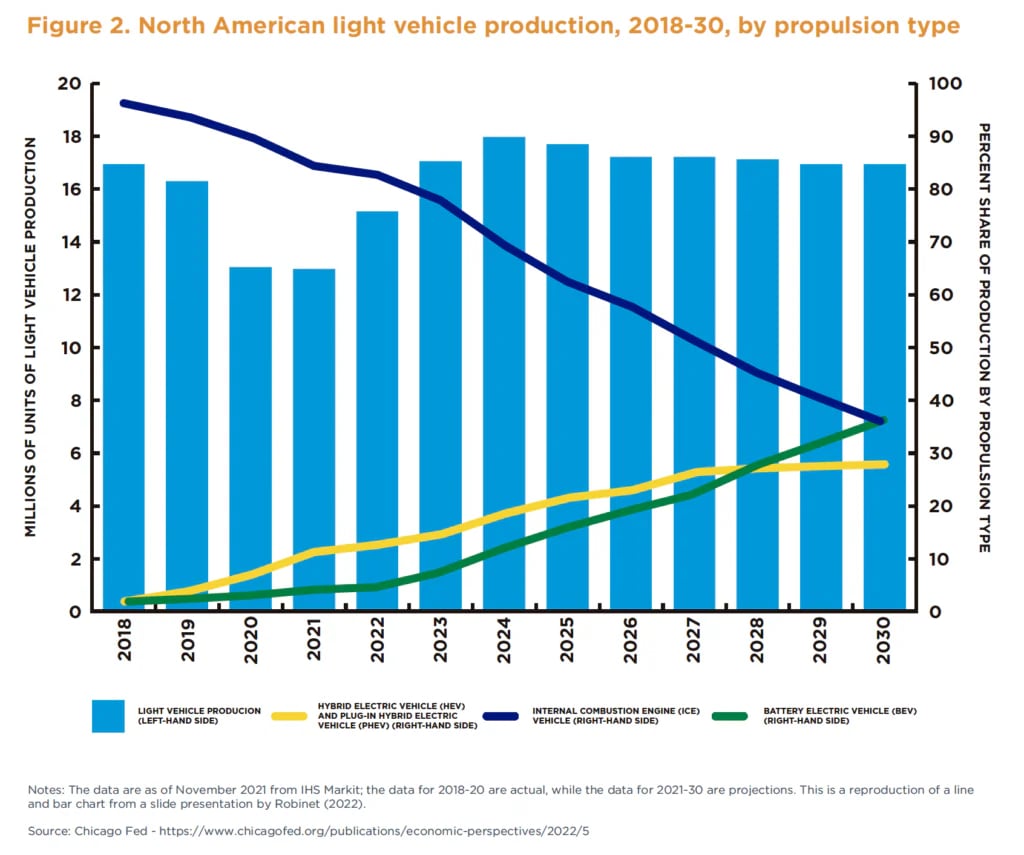

Electric vehicles require fewer parts, compared to an internal combustion engine. As the industry is in transition, so too are the production networks throughout North America. Governments and private industry are facilitating growth in the EV industry with funding and incentives. More than a dozen new incentives enacted through the Inflation Reduction Act, the Infrastructure Investment and Jobs Act, and the CHIPS Act have driven investment and announced jobs. Mexico also has electromobility initiatives that support the USMCA goals.

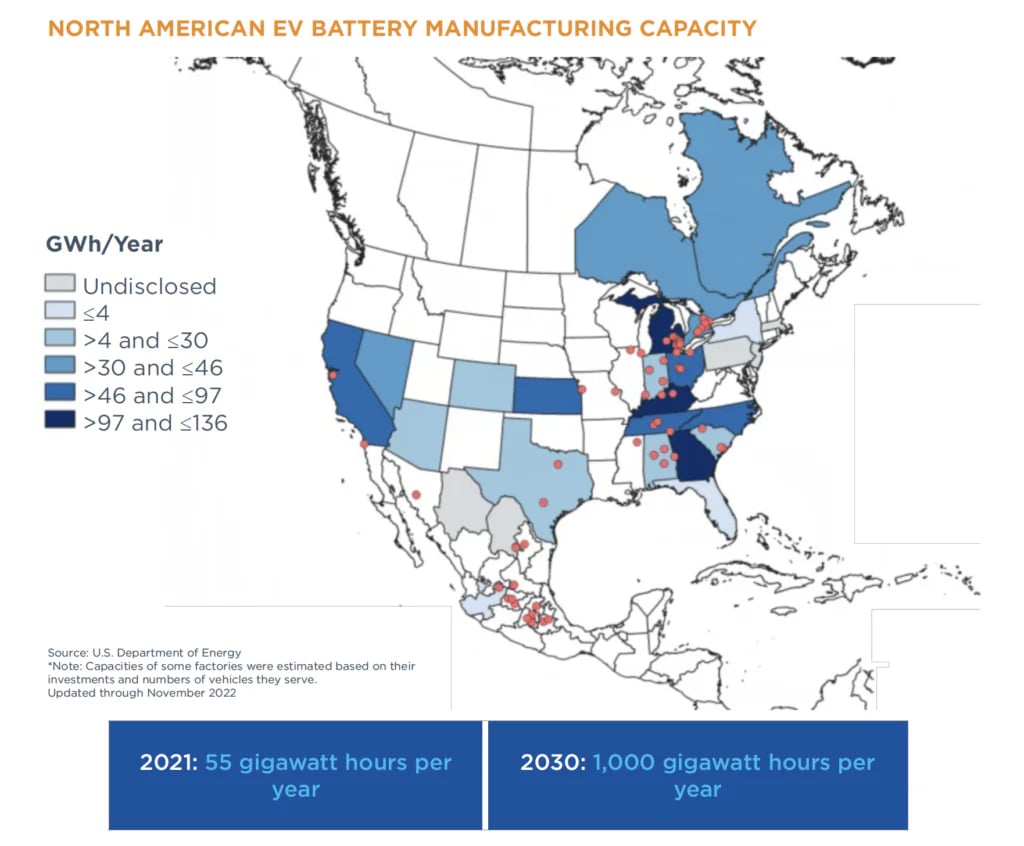

In 2021, two-thirds of plug-in EVs were assembled in the United States. Despite many new EV launches scheduled over the next few years, there is significant capacity gap in mining and refining battery materials. The United States lags far behind China. The Inflation Reduction Act will likely establish an EV supply chain for the long-term and draw large investments in EV battery capacity. By 2030, EV battery manufacturing capacity in North America will likely increase 20 times.

The battery pack of an EV is bulky and challenging to ship long distances, and accounts for about one-third of the total vehicle cost. Many of these facilities will co-locate with assembly plants for EV’s, similar to the ICE automotive footprint. Mexico is preparing for this opportunity as well as others in the electromobility sector.

Read more insights about USMCA energy in the Mexico Outlook 2024 blog post here.

Mexican EV Automotive Sector

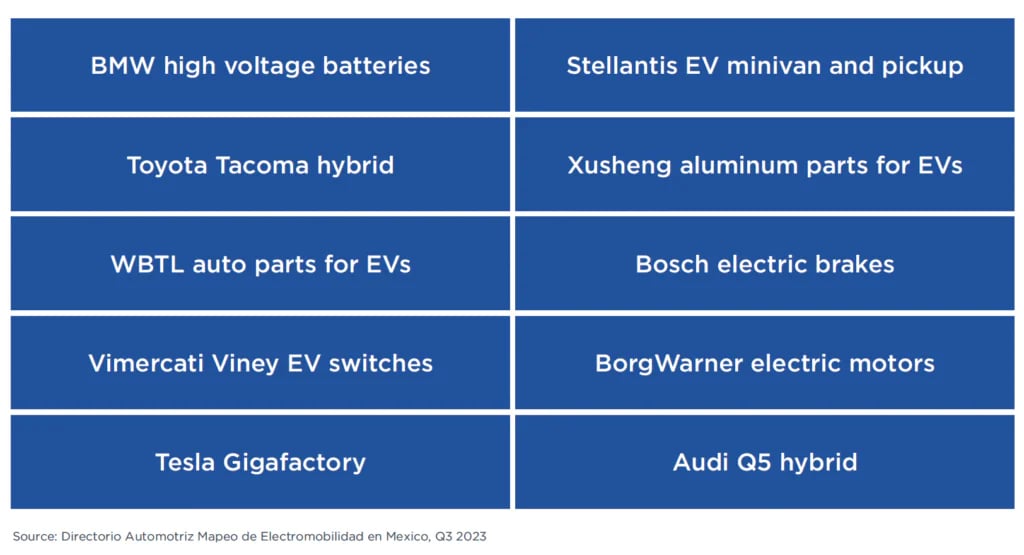

There are many EV models produced in Mexico, including the Ford Mustang Mach-E, several JAC Motors models, the Chevrolet Blazer & Equinox EVs. In 2023, companies like Ford, General Motors, BMW Group, Audi, Giant Motors, and Toyota produced more than 100,000 EVs. In the same year, companies in the electromobility sector announced nearly 100 investments in Mexico. Among them:

There are more than 170 providers (Tier 1&2) of electromobility and electrification components in Mexico. They range from batteries, fuel cell systems, electric drive train, EV brake systems. There are more than 43 providers (Tier 3) of materials for the EV industry.

Mexico will be an important player in the transition to electric vehicles. Mexico the best ally to the U.S. to strengthen supply chains. Its growth potential is challenged by energy supply and regulation. EV sales in Mexico are expected to grow over coming years in the Mexican market, as Mexico pushes toward electrification goals.