Explore the comprehensive resources of the US-Mexico border economy, trade boom, transportation infrastructure, nearshoring and cross-border collaboration.

DOWNLOAD THE FREE E-BOOK

The US-Mexico Border BoomThe Rise of Cross-Border Manufacturing

The roots of the cross-border manufacturing boom trace back to the Maquiladora Program, implemented in the 1960s. This program allowed foreign firms to establish factories in Mexico and import materials duty-free. These are then assembled and exported back. The program’s evolution into the IMMEX program expanded the opportunity by allowing a wider array of goods to be produced.

Nearly 60% of today’s maquiladora (or IMMEX) operations are along the US-Mexico border zone. The IMMEX industry employs about 3 million workers (2022) with about 35% of the country’s manufacturing sector jobs in the sector. IMMEX companies pay about 40% more, on average, than manufacturers that are not in the export sector.

👉 Read more about the History of Manufacturing in Mexico.

The US-Mexico-Canada Agreement and Nearshoring Impact

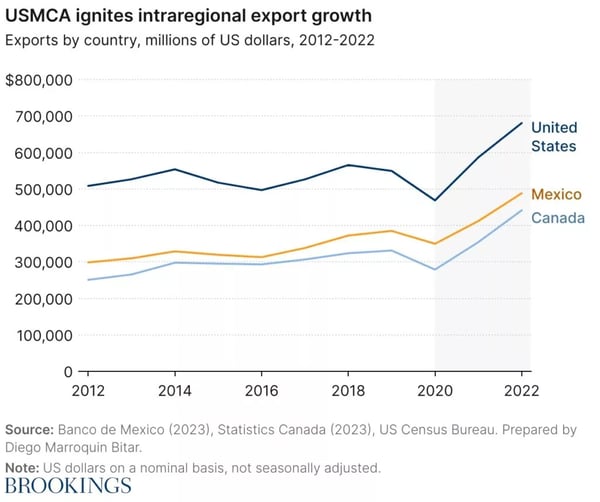

Further propelling this trade growth was the signing of NAFTA in 1994. It eliminated many tariffs and boosted cross-border trade. Economists largely agree that NAFTA benefited North America’s economies. Regional trade increased sharply over the treaty’s first two decades, from roughly $290 billion in 1993 to more than $1.1 trillion in 2016. Cross-border investment also surged. US foreign direct investment (FDI) stock in Mexico increasing in that period from $15 billion to more than $100 billion.

The recent transition from NAFTA to the United States-Mexico-Canada Agreement (USMCA) has further solidified the trade relationship. It added modern provisions to address 21st-century trade challenges and opportunities. The last three years have witnessed remarkable progress in expanding trade, investment, and employment under the USMCA certificate framework.

Moreover, USMCA has established a stable policy environment and baseline for North America. It makes it an attractive platform for developing comprehensive supply chains in sectors such as electric vehicles (EVs) and semiconductors, tackling climate change and fostering clean energy, and expanding access to critical minerals. These strategic initiatives are a major driver of the nearshoring and reshoring trends gaining momentum across industries.

Key Drivers to Cross-Border Manufacturing

The rise in US-Mexico cross-border manufacturing has been fueled by trade agreements and incentive programs, as well as a cultural shift and infrastructure improvements. Robust economic ties between the US and Mexico, exemplified by Mexico becoming the US’ top trading partner in 2019, underscore the significant impact of these strategic initiatives.

Several key factors contribute to the success of cross-border manufacturing and trade between the United States and Mexico. Additional to foundational support like trade agreements, incentive programs and infrastructural developments, other factors play a role in the success of nearshore outsourcing:

Keys to Cross-Border Manufacturing Success

These elements combined have both strengthened economic ties and boosted the competitiveness of North American manufacturing industries on the global stage.

The Future of the US-Mexico Border

The future of the US-Mexico border region is being shaped by several factors. New US legislation is incentivizing reshoring and growth for economic and security reasons. Border states are attracting manufacturing investments for specialized processes, leveraging tax breaks, training programs, and business-friendly initiatives to entice companies to bring back key supply chain components, utilizing Mexico's manufacturing sector.

Nearshoring and friendshoring trends are bringing more manufacturers to the border region, strengthening an interconnected network of manufacturing facilities. Experts predict an increase in these connected ecosystems that include manufacturing, assembly, testing, packaging, warehouse, and logistics facilities.

The US-Mexico Border Infrastructure

The unique environment along the US-Mexico border is characterized by a fluid, dynamic exchange of goods, services, and people. This region is a crucial gateway for commerce between Mexico and United States relations, serving as an essential link in global supply chains and a key component of Mexico exports to US.

- 30 Million people live within 100 miles of the US-Mexico border

- 3.3% Growth of the US population along the border since 2012

- 700,000 daily individuals cross the US-Mexico border (2022)

- 5 Million jobs are supported by US-Mexico trade

- $1.5 Million worth of goods cross the US-Mexico border every minute (2022)

- $855 Billion worth of trade in goods and services between US and Mexico (2022)

- Mexico is the primary trade partner with the US (2023)

- 49 border crossings along the US-Mexico border

- 68% of US-Mexico trade passes through the Texas-Mexico border (2019)

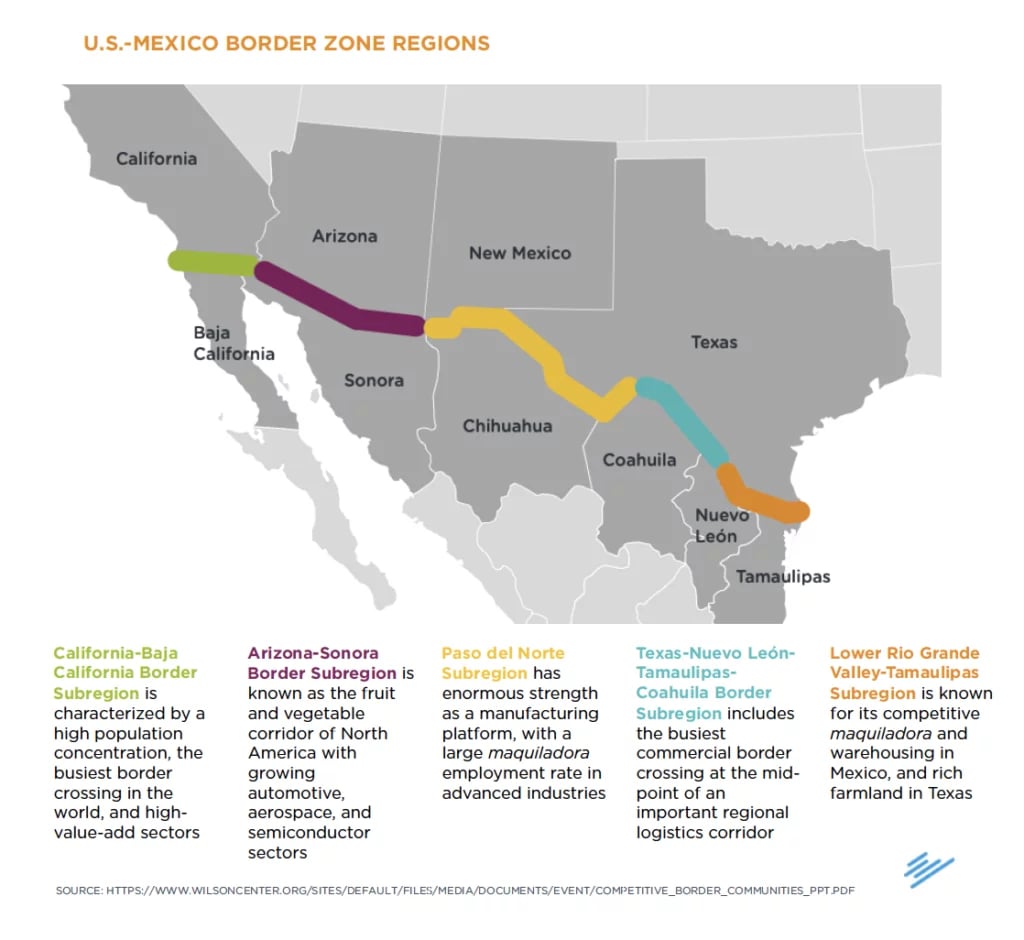

The Wilson Center Mexico Institute describes the US-Mexico border as a set of five "mega-regions" built on joint production and advanced manufacturing. Each is defined by critical infrastructure such as land ports of entry, highway networks, and railway systems.

Digital connectivity further enables seamless coordination between stakeholders involved in cross-border trade. This integrated physical and digital infrastructure significantly bolsters the region’s trade capacity, fueling economic prosperity on both sides.

A mere 10-minute reduction in border wait times could generate an additional $26 million worth of cargo entering the United States each month. Mexico purchases 16% of U.S. exports, often utilizing them in transformation processes and returning finished goods, underlining the advantages of nearshoring.

US-Mexico Relationship and Economic Cooperation

The United States and Mexico maintain a relationship of cooperation and mutual understanding. This helps overcome challenges associated with the development of border crossing projects. The 2022 U.S. infrastructure law contributes $3.4 billion to modernize land ports of entry, with Mexico pledging an additional $1.5 billion.

This joint initiative supports Mexico trade partners efforts to align priorities and enhance security and efficiency in the flow of commerce and people.

Insights from Border Manufacturers

The border economy has shifted from "just in time" to "just in case," with more goods stored on the U.S. side. Cross-border supply chains are adapting to these changes.

Since the transition from NAFTA to USMCA, the value of two-way agricultural trade has increased by 44% to $73.14 billion (2022).

Migration and infrastructure bottlenecks continue to present challenges. Annual migratory influxes of 300,000 people affect labor and infrastructure demands, impacting the agility of the border manufacturing environment.

The Nearshoring Boom in Mexico

The USMCA positions North America for global competitiveness. Mexico is increasingly vital to nearshoring and reshoring strategies. Its proximity, cost-effective labor force, and trade agreements make it a prime location for manufacturing companies in Mexico.

Mexico saw $29 billion in foreign direct investment in the first six months of 2023, including major projects like Tesla's $5 billion factory and over $1 billion in supporting Chinese investment. These developments signal the advantages of nearshoring in Mexico.

Made in the USMCA: Integrated Supply Chains

North American supply chains are deeply interconnected. Intermediate goods traded between countries support 9.5 million jobs and over $1.5 trillion in trade. These supply chains enhance efficiency and competitiveness for Mexico trade partners.

Collaborative US-Mexico Manufacturing Experts

Mexico's workforce is increasingly skilled, with collaboration across engineers, designers, and technical experts from all three USMCA nations. This collaboration fosters innovation and strengthens binational manufacturing operations.

DOWNLOAD THE FREE E-BOOK

The US-Mexico Border BoomConclusion: Collaboration Across Borders

The US-Mexico border is more than a physical boundary—it is a source of innovation, cooperation, and economic strength. As North America continues to evolve, nearshoring, reshoring, and collaborative infrastructure will be essential to securing a resilient and prosperous future.

This blog post summarizes the e-book “The US-Mexico Border Boom: a Look into the Thriving Cross-Border Manufacturing Industry” available for free download.

References

Sources used in the elaboration of this e-book (alphabetical):

- The Americas face a historic opportunity: will the region grasp it? (2023) The Economist

- Arizona-Sonora Border Master Plan (2022) by Arizona Department of Transportation

- Bipartisan Infrastructure Law Construction Projects (2023) by U.S. General Services Administration

- Building the Cross-Border Economy: Local Leadership in the Arizona-Sonora Megaregion (2022) by Arizona Mexico Commission

- The Cali-Baja Regional Economy: Production, Employment, Trade & Investment (2022) by the University of San Diego Knauss School of Business

- California-Baja California Border Crossings and Trade Data (2023) by San Diego Association of Governments

- Competitive Border Communities; Mapping and Developing U.S.-Mexico Transborder Industries (2015) by Wilson Center

- Factors Influencing Cross-Border Cooperation in North America (2023) by Mary Fiagbe, Major Papers. 235.

- International Trade Corridor Plan (2022) by Texas Department of Transportation

- Mexico’s Foreign Affairs Statistics (2023) by Mexican Embassy

- NAFTA’s Economic Impact (2023) by Council on Foreign Relations

- Neareshoring Drives Demand in U.S.-Mexico Industrial Real Estate and Infrastructure Markets (2023) by Macquarie Group

- Redefining and Governing the Border Binational Commons (2023) by Baker Institute for Public Policy

- San Diego-Calexico Border Region Economy (2022) by San Diego Chamber of Commerce

- Smart Border Coalition: About the Border (2023) by Smart Border Coalition

- The Southern Border Region at a Glance (2023) by Alliance San Diego

- Supply Chain Sustainability (2022) by EY

- The Economic Impact of a More Efficient U.S.-Mexico Border (2022) by Atlantic Council

- The United States-Mexico-Canada Agreement (USMCA) (2023) by Office of the United States Trade Representative

- U.S.-Mexico Border: Trade and Transportation (2015) by Site Selection Magazine

- U.S.-Mexico Trade and Transportation Infrastructure Study (2019) by North American Development Bank

- US-Mexico Border Transportation Master Plan (2022) by Texas Department of Transportation

- US-Mexico Border Transportation Master Plan Executive Summary (2022) by Texas Department of Transportation

- USMCA at 3: Reflecting on Impact and Charting the Future (2023) by Brookings Institution

- USMCA Tracker (2023) by Brookings Institution

- USMCA: Legal Text (2023) by USTR

- US-Mexico Border Transportation Master Plan – Lower Rio Grande Valley (2022) by Texas Department of Transportation

- US-Mexico Border: Commodity Flows between the United States and Mexico through Arizona Border Ports of Entry (BPOEs) (2023) by Eller College of Management, University of Arizona

- U.S.-Mexico Relations (2023) by U.S. Department of State

- US-Mexico Trade: A Folklife Perspective (1993) by Smithsonian Institution