A Rising Destination for Japanese Investment

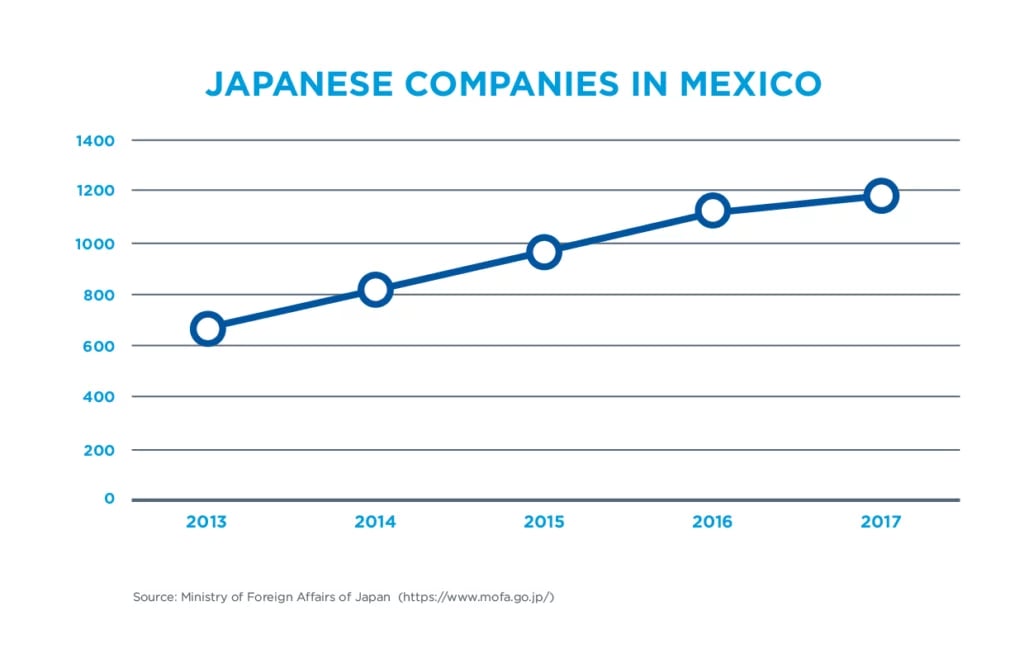

As global manufacturing strategies evolve, Mexico has emerged as a strategic hub for Japanese companies seeking cost-effective, resilient, and trade-friendly operations in the Americas. With over 1,200 Japanese firms now operating in Mexico, the country is fast becoming a key partner in Japan’s international supply chain strategy—especially in the automotive, electronics, and energy sectors.

This article explores why Japanese manufacturers are increasingly investing in Mexico, the benefits of this strategic alignment, and how the Mexico-Japan relationship strengthens North American industrial competitiveness in the context of nearshoring and friendshoring trends.

Why Japanese Companies Are Choosing Mexico

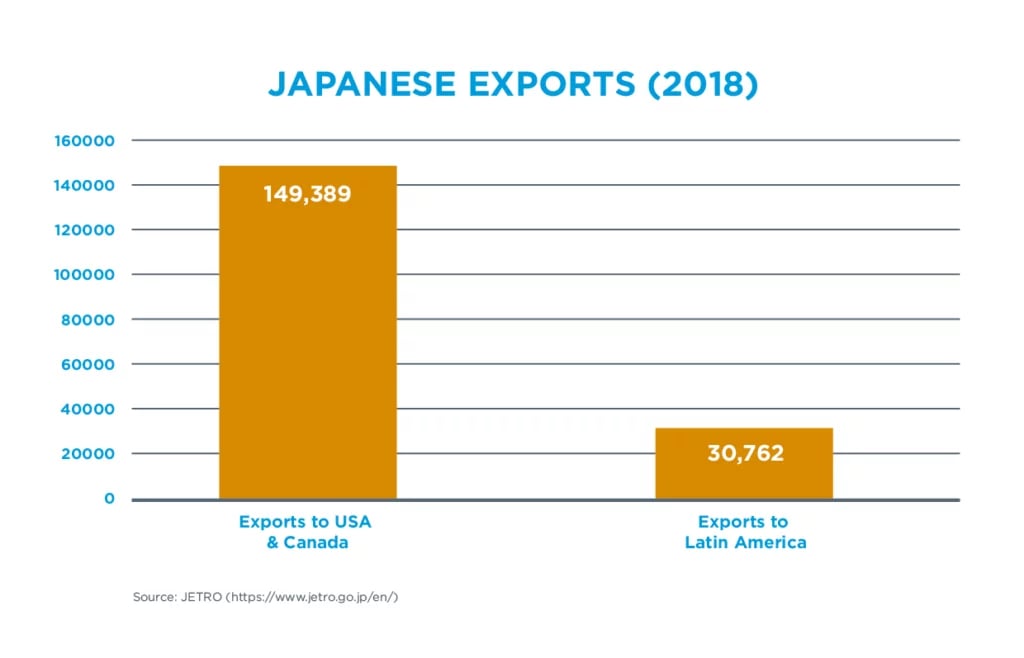

Japan has long viewed Mexico as a strategic export base into the United States and Canada, particularly under favorable trade frameworks like the USMCA and the Japan-Mexico Economic Partnership Agreement. Key reasons behind this growing trend include:

-

Proximity to the U.S. market

-

Skilled labor at competitive costs

-

Robust infrastructure and industrial parks

-

Favorable customs rules and trade agreements

-

Growing engineering and automotive clusters

Mexico’s role in the regional supply chain has expanded rapidly, driven by global OEMs seeking alternatives to Asia in response to geopolitical risks, shipping delays, and rising costs.

Japanese Manufacturers in Mexico: Key Players

From OEMs to Tier 1 and Tier 2 suppliers, Japanese companies are investing across Mexico’s industrial landscape. Here are some of the notable manufacturers:

-

Honda de México – Operates major assembly plants in Celaya, Guanajuato, producing models like the Accord and CR-V.

-

Mabuchi Motor – Manufactures small motors for automotive and electronics in Aguascalientes.

-

Sharp Electrónica México (SEMEX) – Produces LCD panels and TVs in Baja California.

-

JFE Steel, Asahi Kasei, Toyoda Iron Works, Kyoto Platec – Suppliers based in Guanajuato supporting auto manufacturing.

-

Mitsui Chemicals, Nikkei MC Aluminum, Kitagawa – Focus on components, resins, and light metal parts.

-

Topre, Shimizu, Ishimitsu Kogyo – Tier 1 and Tier 2 suppliers with operations in Querétaro.

Together, these firms represent a significant portion of Japan’s $18 billion+ in auto-related foreign direct investment (FDI) in Mexico.

Why Mexico Makes Strategic Sense for Japan

Japanese manufacturers are not simply chasing cost savings—they are aligning with broader economic and operational priorities:

-

Diversification: Mexico offers a reliable alternative to China and Southeast Asia for parts sourcing and final assembly.

-

Trade Access: As a USMCA member, Mexico enables duty-free exports to the U.S. and Canada.

-

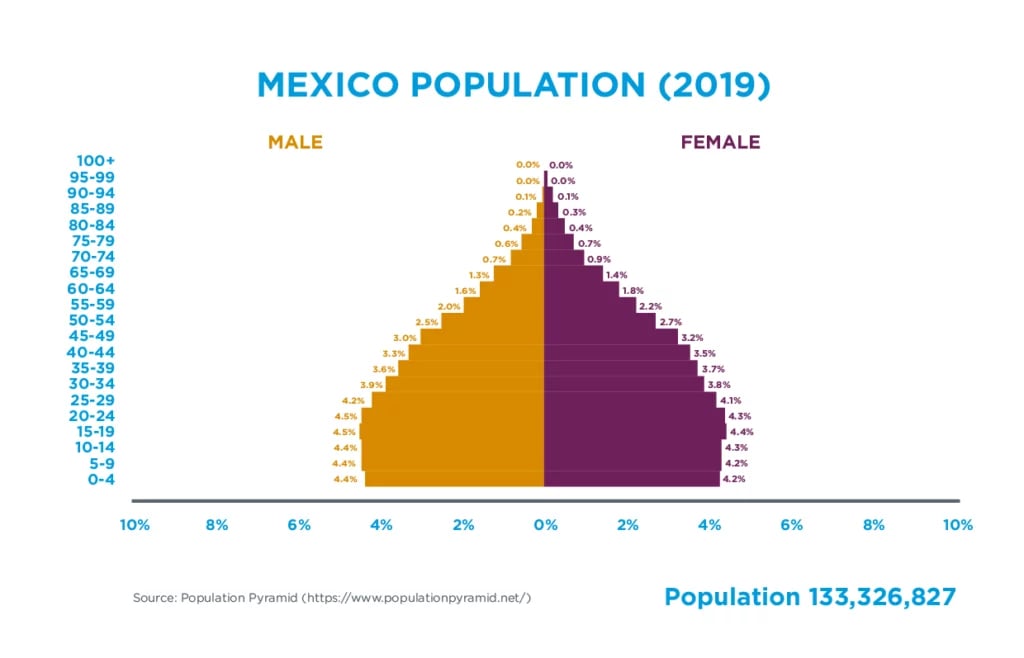

Workforce Readiness: Mexico produces over 120,000 engineering graduates annually, ensuring a strong technical talent pipeline.

-

Infrastructure Synergy: Access to highways, rail, seaports, and international airports supports global logistics.

In this way, Japan is leveraging Mexico not only as a manufacturing base but as a critical partner in regional supply chain realignment.

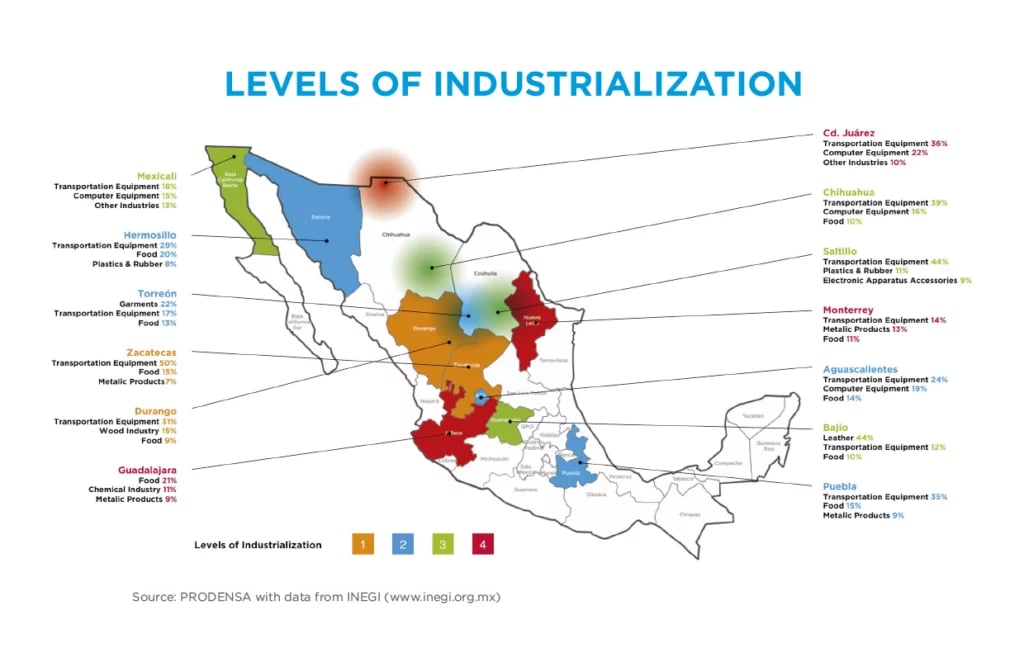

Regional Impact: Aguascalientes, Guanajuato, and Querétaro

States like Aguascalientes, Guanajuato, and Querétaro have become hotspots for Japanese FDI. Aguascalientes alone has received over US $8.8 billion in Japanese investment since 1999, including $411 million in 2024. Guanajuato hosts numerous suppliers feeding into auto clusters led by Honda, Mazda, and Toyota. Querétaro, with its growing aerospace and auto sectors, attracts high-tech parts producers.

This regional concentration has created specialized ecosystems that support supplier collaboration, talent development, and binational innovation.

Nearshoring and Friendshoring: Why This Matters Now

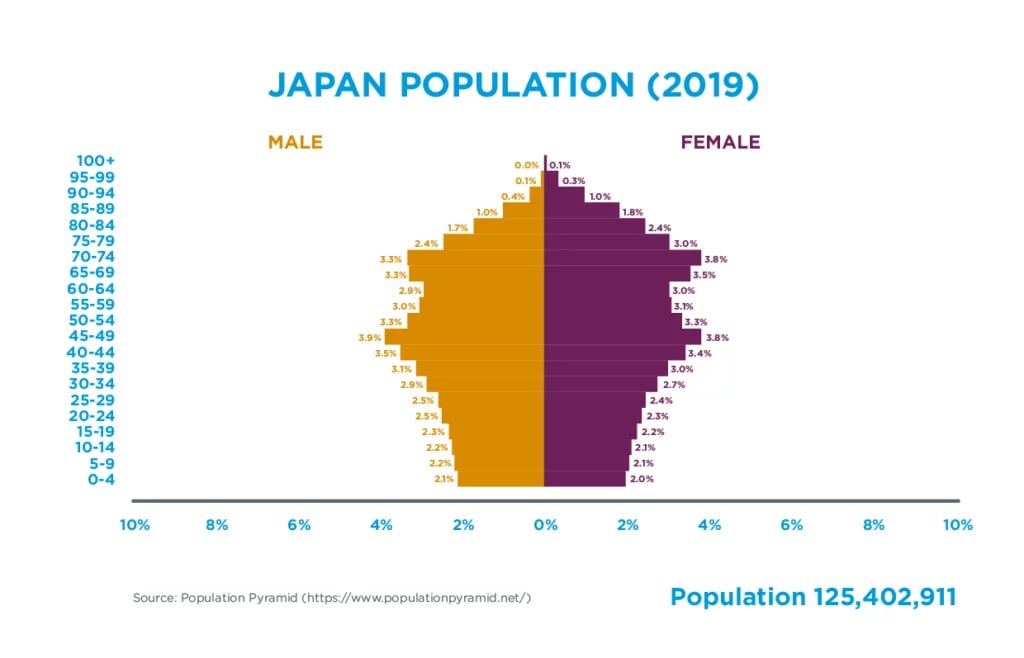

As nearshoring and friendshoring reshape global manufacturing, Japan’s deepening ties with Mexico strengthen North American competitiveness. These partnerships reduce dependency on distant offshore hubs, shorten lead times, and increase resilience in key sectors like mobility, electronics, and renewable energy.

Japan’s investment in Mexico also complements U.S. reshoring strategies, contributing to a more integrated and balanced trilateral industrial network under the USMCA.

Conclusion: A Strategic Long-Term Alliance

Japanese manufacturers in Mexico represent more than a shift in location—they signify a shift in strategy. As global supply chains adapt to new realities, Mexico offers Japan a stable, skilled, and strategically positioned partner.

With strong trade agreements, competitive labor, and regional integration, Mexico is not just a manufacturing site—it is a gateway to the future of Japanese industrial growth in the Americas.

Are you interested in learning more about the opportunities of the Mexican market for nearshoring operations in North America?