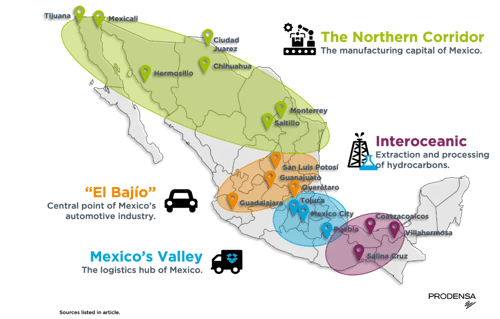

Industrial corridors refer to geographical areas that have a concentration of manufacturing, industrial and logistics activities. There are numerous corridors across Mexico. They play a critical role in shaping the North American manufacturing and industry sectors’ future.

Mexico’s industrial corridors have great significance in boosting the country’s economic development, while reinforcing the North American manufacturing and industrial sectors. These corridors enhance productivity and competitiveness rates for manufacturing and industrial activities. They provide a physical platform that offers excellent transportation links, modern communications systems, and various business incentives.

Throughout Mexico, there are specialized zones known for their industrial presence. These industrial corridors form a natural land bridge for North American trade and commerce, with easy access to seaports, airports and land gateways. Therefore, they have a tremendous impact on connecting the supply chains across borders. This makes it easier for manufacturers to rely on the movement of products and suppliers between Canada, the United States, and Mexico.

The Northern Industrial Corridor

The Northern Industrial Corridor is made up of a group of northern states in Mexico such as Baja California, Nuevo León, Chihuahua, Sonora, Tamaulipas, Coahuila and Durango. These states are a vital part of the supply chains of many important sectors like construction, mining, aerospace and automotive, among others, of the United States and Canada.

The Northern Industrial Corridor in Mexico borders the United States, thus having a strategic position and advantage for international commerce. For this reason nearly 90% of the country’s maquiladoras are located within the Northern Industrial Corridor. Over 1 million Mexicans work in these 3,000+ maquiladora plants.

Maquiladoras are part of the IMMEX Program, and are factories that import raw material into Mexico, use it in production or transformation process, and then export it. The program offers foreign companies the opportunity under a preferential tax and fiscal program once certified. Read more about the IMMEX Program.

Mexico’s Valley Industrial Corridor

Mexico’s Valley Industrial Corridor is made up by Mexico City and 60 surrounding urban zones through Mexico State and the state of Hidalgo. Approximately 20% of the country’s population resides in the corridor. It’s the logistics hub of Mexico. Nearly 80% of the e-commerce market potential is concentrated in the corridor. Mexico’s Valley is considered the biggest industrial region in the country, with a gross rentable area of 5.52 square miles.

In fact, the CTT Logistics Corridor (Cuautitlan-Tultitlan-Tepotzotlan), touted as the largest and most dynamic of the nine* that make up the entire Mexico Valley zone, has seen a 50% increase in the number of square meters of warehouse and distribution spaces over the last 4 years.

Mexico is poised to take on an important role in global logistics and e-commerce in the coming years. For instance, between Q1 2020 and Q1 2023, Mercado Libre and Amazon absorbed almost 9.7 million square feet of warehouse and fulfillment centers nationwide. Mexico’s e-commerce sector is projecting high growth, due to increased access to online shopping in Mexico’s middle class, as well as its strategic location to serve the U.S. fulfillment needs.

*Centro, Coacalco, Huehuetoco Zumpango, Iztapala, Naucalpan, Tlalnepantla, Toluca, Vallejo Azcapotzalco, Cuautitlan-Tultitlan-Tepotzotlan

Industrial Corridor “El Bajío”

Within the “Bajío” region of Mexico, which is found in the central Northern section of the country, are the industrial powerhouse states of Querétaro, Guanajuato, Aguascalientes, Jalisco, San Luis Potosí and Zacatecas. It is especially known for its automotive production. The region is home to the assembly operations of 8 different automotive OEMs, with the state of Guanajuato housing 6 of them. These companies include General Motors, Honda, Mazda, Toyota, Volkswagen, Ford, Nissan, and BMW as well as a number of heavy truck producers in the zone.

Additionally, there is an extensive network of 800+ automotive suppliers in the corridor. With the nearshoring boom and the ratification of the USMCA, experts think this sector will continue growing and providing optimization for the North American industry. The “El Bajío” Industrial Corridor accounts for 19% of all industrial buildings nationwide.

Mexico’s trade liberalization efforts means that the market is one of the most open and competitive in the world. Mexico is a global leader in automotive manufacturing:

.webp?width=500&height=291&name=Bajio-Industrial-Corridor-2%20(1).webp)

Read more about the collaboration of the North American automotive industry in our free e-book.

Interoceanic Industrial Corridor

The southern part of Mexico has been traditionally known for its concentration of extraction, exploration and processing of hydrocarbons for Mexico. Recently, it has been the focus of potential growth in food products and other industrial development. The intention of the government is to strengthen the economic activity in the south of Mexico, creating a connection between global markets like Asia, Europe, the United States, and other Latin American countries. The Interoceanic Industrial Corridor is an important hydrocarbon hub. But it is also a potential location for future growth, aimed at alleviating resource scarcity in other parts of Mexico.

The Mexican government has defined Special Economic Zones (ZEE in Spanish) in order to try to equalize the productivity at a national level. This has sparked the growth of these regions and the communities within. The Mexican government offers fiscal and labor benefits, a special customs regime, and support programs, among others. Their plans communicated in 2023 include 10 new industrial parks, and the project’s anchor, the 186-mile freight rail line linking Mexico’s Pacific and Gulf coasts, is scheduled to be finished soon and aims to compete with the Panama Canal as a channel to move goods. There are also plans for a pipeline, potential wind farms, and new airports, among others.

.webp?width=500&height=382&name=Interoceanic-Corridor%20(1).webp)

Despite the Interoceanic Industrial Corridor’s considerable potential to facilitate the interoceanic transport of goods, the capacity to handle major container traffic is still prospective. The project is not free from scrutiny, ranging from environmental activism by indigenous groups, to poor outlook of national returns on infrastructure spending by prioritizing it over other port and energy infrastructure investments.

The Nearshoring Effect

Increased investment from the nearshoring boom has impacted the availability of the established industrial parks in Mexico. According to AMPIP, the average occupation rate of Mexican industrial parks at a national level was 97% in 2022. AMPIP is the Mexican Association of Private Industrial Parks. They represent the vast majority of sites geared toward foreign investors. As of Q2 2023, there are a total of 430 industrial parks in 27 Mexican states.

Mexico is undergoing great growth, and with that can come some pains. There are challenges to finding the right site, and executing quick enough in a market full of demand. Alejandro Mendoza, President of Real Estate at Prodensa, defines the top influences for a site selection decision for nearshoring companies:

- Availability of industrial space

- Proximity, attractiveness and ease for arrival (corporate and clients), including visibility, security and climate

- Presence of other well-known competitors in the area

- Proximity of supplier base and logistics in-between

- Direct access and communications structure of the site and surrounding area

- Park with good infrastructure

- Experienced landlord with the ability to support tenant improvements

- Legal and institutional factors, including licensing and registration

- Availability of stable workforce

- Costs, taxes or incentives such as credits

.webp?width=1024&height=430&name=Prodensa-06-2-1024x430%20(1).webp)

References & Sources:

2. https://www.dripcapital.com/es-mx/recursos/blog/corredores-industriales-mexico

5. https://advance-realestate.com/adblog/en/industrial-corridor-what-it-is-and-why-its-important/

6. https://www.gob.mx/se/articulos/las-zonas-economicas-especiales-de-mexico

8. https://country.eiu.com/article.aspx?articleid=1873261770&Country=Mexico&topic=Economy&subtopic=F_1