The pandemic drove unprecedented change in global organizations, placing more attention on where they do business.

The pace of business increased tenfold with digital adoption. A new definition of an ‘optimal’ talent mix was created with new, emerging requirements. The very nature of organizations’ value proposition was put into question.

And being closer to North America became advantageous, even strategic. Agile organizations, being intensely customer-focused, have had to adapt to rapid market changes and consumer preferences.

Consumers, now more than ever, have revolutionized their interaction with their brands and services. The pandemic created a spotlight over manufacturing supply chains, with a spike in consumer-driven e-commerce coming just as many were struggling with already-weakened global logistics. It became clear quickly that complicated supply chains were not the answer to agility. Many global organizations continue to evaluate if nearshoring their manufacturing operations to North America could alleviate these complexities.

Nearshoring in North America can build resilience into supply chains, increase protections to intellectual property under the USMCA, and leverage cultural impacts to productivity, among others. And the concept of ally-shoring aligns the nearshoring trend with the growing desire to do business with like-minded democratic partners.

Mexico: positioned to serve the Americas

Mexico is a strategic ally for nearshoring operations – in manufacturing as well as mindfacturing. Past decades of population growth resulted in a generous labor supply. The workforce is often cost-effective and strategically skilled for foreign direct investment since the onset of NAFTA. Sharing over 2,000 miles of border allows managing directors to have more oversight and be more hands-on with products or knowledge transfer. Mexico is also a gateway to many free trade agreements and access to global markets. Etcetera.

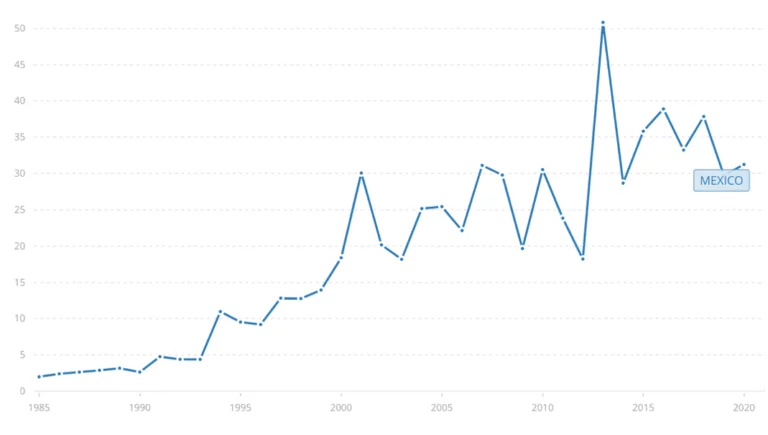

Global organizations continue to inject capital (physical, intellectual, and operational) into Mexico, elevating its strategic role for global footprints. Mexico captured over $30 billion dollars in FDI over the year 2021, of which 44% represented new investment.

Foreign direct investment in Mexico, net inflows (BoP, current US$)

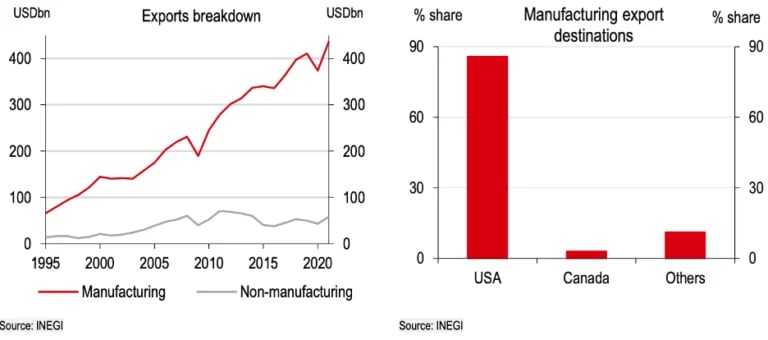

Manufacturing in Mexico

Mexican manufacturing exports are on the rise, strongly driven by trade with the United States.

HSBC Global Research, 14 July 2022

For those business cases that validate an entry into the Mexican market, there are a number of options for deployment – from getting your toes wet through a commercial partnership, to establishing a manufacturing operation alone or through an operational partner.

Organizations considering nearshoring operations to North America will often source partial capabilities in Mexico through contract manufacturing, as a first approach. When more control over the production and quality process is required, a standalone manufacturing operation may be needed.

For manufacturing operations seeking limited exposure in Mexico, an operational partner acts as a local compliance officer. They ensure that all non-production-related parts of the operation run smoothly. Shelter service providers offer umbrella support, either through a single entity with multiple allocated clients, or an exclusively dedicated entity. Shelter models exist to mitigate risk and exposure from operating a manufacturing facility in a foreign country.

Additionally, Mexico provides many incentives to foreign manufacturers that are nearshoring operations. The common IMMEX Program provides a cost-effective way to access a qualified and steady, manufacturing workforce in Mexico. This manufacture-for-export industry employs 2.88 million workers, most of which are located on the border states to the U.S. market, enjoying additional tax incentives.

Inshoring: a North American solution

Nearshoring will most likely continue over the long-term, despite challenges to certain supply chains and the local business environment. Operational partners exist to help navigate the rule changes while facilitating the best practices of world class manufacturing organizations.

Speed-to-market can be crucial for suppliers considering nearshoring operations with their clients. So Prodensa built a proprietary operational model, aimed to inshore manufacturing operations through the domestic U.S. market. Inshoring was designed to truly eliminate the exposure of doing business in a foreign country, while leveraging the cost-effective manufacturing solution that Mexico provides.

- No services contract with an any foreign entity

- Organization does not have a Permanent Establishment in Mexico

- Pre-existing IMMEX manufacturing or service operations, ready for occupancy

- All international commerce and local compliance handled by Prodensa experts

- Maintain 100% ownership of assets, including intellectual property

- Full control over site selection, workforce, and finished goods

- Access to preferential rates and best practices, earned by Prodensa over 35+ years

- No strings attached – open-ended transferal of operation to another entity

Learn more about inshoring here, or read more about the regional benefits to nearshoring.