SHELTER SERVICES IN MEXICO

The premier firm with coverage in all major industrial zones in Mexico.

YOUR PARTNERS IN MEXICO

Turning visions into ventures.

With a customized approach to operating, there are several ways to operate a manufacturing facility in Mexico. Each one ranges in incentives, compliance, risks, and control over the operation.

The easiest way to manufacture your product in Mexico is through a partner called a Shelter service provider, which limits your legal exposure.

What is shelter?

A model for operating a manufacturing operation in Mexico with local partners. We own the legal entity and take on the compliance burden until a scheduled transfer of ownership. It is a modality recognized by the Mexican authorities, with its own set of decrees and requirements.

The Shelter service model accomodates a cost center operation, affiliated with the IMMEX Program in Mexico.

FREQUENTLY ASKED QUESTIONS

Learn more about shelter services in Mexico. Then reach out so we can answer all your questions.

Shelter service providers in Mexico provide special benefits and resources to foreign manufacturers through Mexico's IMMEX Program.

They are legal, domestic business entities that create a "shelter" (or "umbrella") in which to establish your manufacturing operation, building upon a compliance framework of local expertise.

Benefits to working with a shelter service provider:

- Knowledge and best practice from multi-industry experience

- Reduced liability in the start up and ongoing operations

- Access to networks of providers, talent pools and associations

- Possibility of a faster start up, depending on the business case

Requirements of the Shelter operation in Mexico:

- Only suitable for cost-center type of operations

- Taxation via the Safe Harbor rules

- Partial deductibility of some labor benefits

- No domestic sales in Mexico are allowed (virtual export is allowed)

The alternatives to a shelter operation:

A wholly-owned subsidiary provides the foreign parent company full ownership of the Mexican operation from day one. There will be a need to assess tax and transfer pricing studies. If it is a cost center, the operation is funded through a maquila invoice, including value-added tax. A partner can still provide administrative support over key functional areas as a local vendor.

The IMMEX Program aims to enable foreign companies to produce goods or provide services from Mexico, in a way that is cost-effective while still focusing on quality. You may have heard of “maquiladoras”. These are factories that import raw material into Mexico, use it in a production or transformation process, and then export it to their home country.

IMMEX companies may secure special registration from Mexican customs authorities to operate as a Certified Company, which grants access to certain benefits. The certified companies framework includes VAT/IEPS Certification, Authorized Economic Operator, Certified Commercial Partner, guarantee of interest payment and the Reliable Importer Program. Individual criteria apply for different program access.

VAT Certification can grant a tax credit on these temporary imports that are destined for subsequent export. They can also temporarily import the raw materials and equipment used in the transformation process without the payment of value-added tax.

There are some requirements, of course. Companies in the IMMEX Program in Mexico have to export at least US$500,000 annually, or at least 10% of their total sales. They must also adopt an inventory control system different from the ERP, comply with time frames for the import and export of their goods, and operate in registered locations in Mexico, among others. Read more about the IMMEX Framework and the IMMEX Program in Mexico: A quick guide.

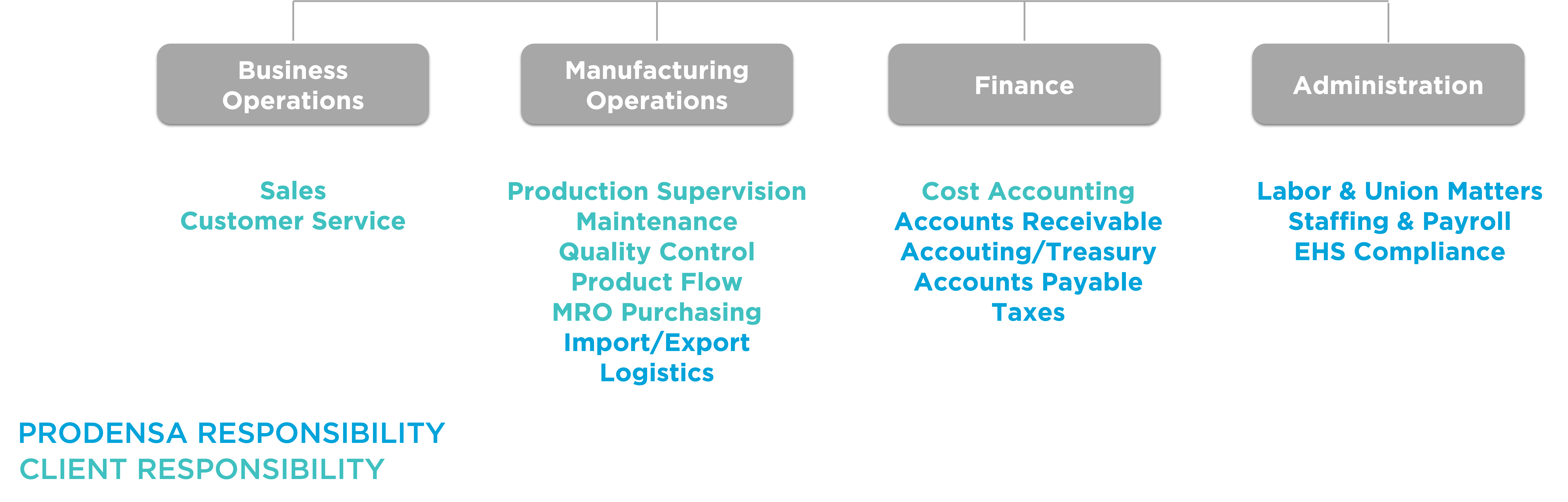

Shelter service operators act as co-operations of your manufacturing operation in Mexico. Activities are governed and tracked against a strict Task Responsibility Matrix. There is a lot of collaboration between the corporate and operations teams; it's important to find partners you can trust in Mexico.

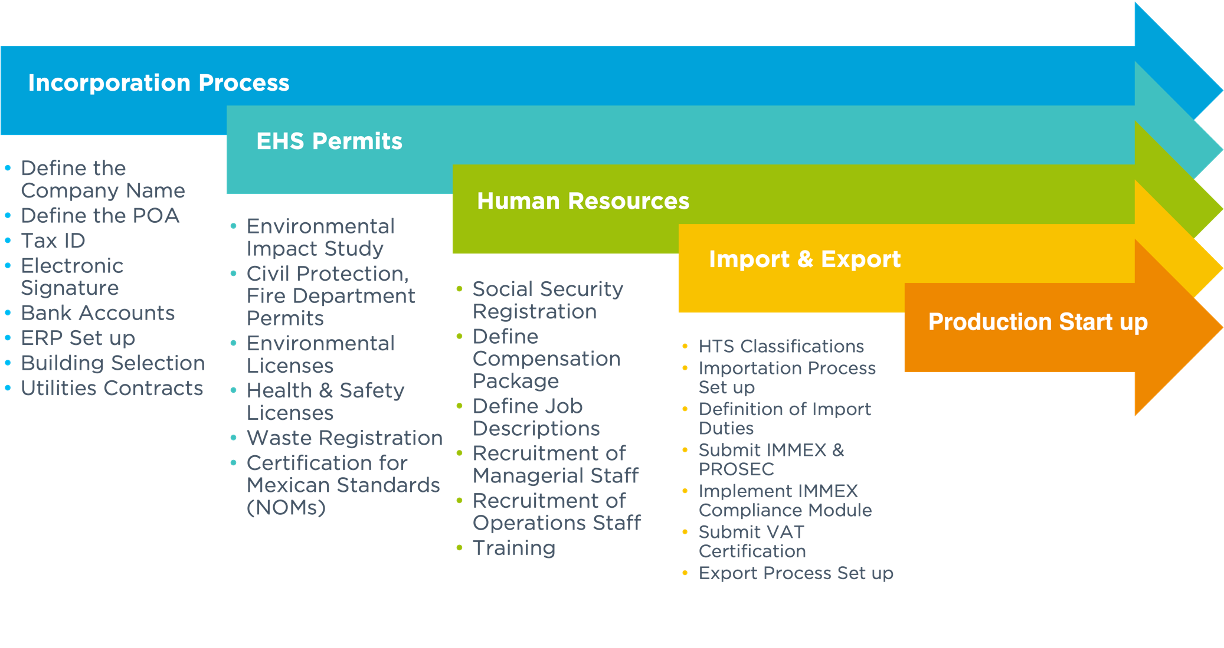

Through a project management methodology, activities are typically divided into three phases:

Pre-Operative Phase. During this phase, the readiness of the business, facility and workforce is of utmost important. In this phase, most of the paperwork for incorporation, permits, studies, agreements, registrations and policies are defined.

Operative Phase. The most value-add is provided by experts mitigate risks and ensure compliance of the operation. Local partners provide administration over the key functional areas of the business, as well as coordinate complimentary services to ensure the productivity of the operation in Mexico.

Phase Out. If working under a Shelter services model in Mexico, it is important to have a detailed and streamlined phase out of support operations. In this stage, the foreign corporation transition to the owner and responsible party of all processes. A proper training and hands-off program is key for business continuity.

Regardless of operational model, it is very important to have a professional project management and reporting system defined throughout the duration of the start up of operations. The methodology should be based on world class principles that take into account timeline, budget and legal compliance.

There are a number of options for a manufacturing facility in Mexico.

Land cost greatly depends on the location and whether it is inside an industrial park or a greenfield. Developed land will typically include the basic infrastructure to allow for the utilities to connect at the foot of the property.

Depending on the market, inventory buildings are commonly available for lease. Companies that prefer purchasing might need to consider going through the process of acquiring land and building their facility to their specific needs.

Historically in the primary markets in Mexico, there have been a high range and variety of industrial buildings for lease: new & used, manufacturing and non-manufacturing use. However, in the past 24 months, due to the increased demand and activity, most markets show very low vacancy rates. Leases are available anywhere from 5 to 10 years. Most of the lease structures are dollar dominated, and are triple net, meaning that the tenant will be responsible to pay the real estate tax, insurance and common area maintenance. Most landlords/developers require a guarantee document from a credit-worthy company, and/or a letter of credit, which they use as a financing instrument with their lending institutions.

The answer varies a lot, including business case, operational structure, certain industry requirements, building specifications, machinery importation, among others.

For a dedicated, legal entity, the timeframe is around 10-15 months to have the operation running and certified. An operational model like Inshoring, one that is pre-existing, could cut down that lead time significantly.

Entity Incorporation if the operating structure requires the incorporation of an entity, consider up to 3 months in your timeline for the process. You will require the (1) Articles of Incorporation, (2) Bylaws, (3) Power of Attorney, (4) Proof of Citizenship, (5) Proof of Residency, (6) Proof of Capital. Additionally, you may need to obtain a tax ID number and an electronic signature required by the tax authority in Mexico (SAT).

LET'S SCHEDULE AN INTRODUCTORY CALL

OPERATIONAL MODEL COMPARISON

A personalized approach to manufacturing in Mexico.Browse clients that call us partners in Mexico.

HOW WE SUPPORT OUR CLIENTS

History of Shelter Services in Mexico

- Maquila Program Predecessor

- Shelter Program to Assist Investors

- NAFTA Success Drives Formality

- Creation of the IMMEX Program

- Tax Reform Boosts Modernity

- A Focused Lense on Compliance

1964 - Maquila Program: Predecessor to the Shelter Program

The Maquila Program was created in part to provide an avenue for U.S. manufacturers to invest in assembly factories on the Mexican side of the border. They were seeking to employ the available population of ex-farm workers returning to Mexico after the dissolution of the Bracero Program in the U.S. Maquiladora factories could import machinery and raw material to Mexico on a temporary basis, to be used in the manufacturing process and then subsequently exported back to the home market for sale, free from duties and tariffs.

1980 - The Shelter Program: Created to Assist Investors in Mexico

By 1980 the growth of the Maquiladora Program had created new business opportunities to serve foreign manufacturing operations in Mexico. Shelter operators in Mexico allow foreigners to invest and partner with Mexican service providers to operate in Mexico without the need to incorporate a legal entity.

Around this same time, Mexico introduced the Value-Added Tax (VAT) at a 16% rate upon repealing the Commercial Income Tax (CIT).

By 1984, foreign investors could be majority shareholders of a Mexican manufacturing entity, replacing the previous 49% limitation.

Mexico joined the GATT in 1986.

1994 - Successful NAFTA Implementation Drives Formality of the Shelter Program

In 1994, Mexico entered into the North America Free Trade Agreement with the United States and Canada. One year later Mexico joined the World Trade Organization.

By 1997, Mexico had aligned themselves with the OECD by implementing transfer pricing rules for maquila factories in Mexico. Shelter operators were exempt from paying income tax, and the value add of the service spurred a growth in shelter operations over the next decades in Mexico.

2006 - Creation of the IMMEX Program

In 2006 the Maquila Program was merged with PITEX, a program for domestic and export sales, to create the IMMEX Program. It was devoted to shelter service operators in Mexico.

In 2012, Mexico's Federal Labor Law was reformed to further formalize working relationships and regulate outsourcing.

2014 - Mexican Tax Reform Boosts Economic Modernity in Mexico

In 2014, the Mexican government introduced the concept of VAT Certification. This allowed maquiladora factories to continue temporary exports without paying taxes, but only after certification. Factories would pay the tax and await a reimbursement from the Mexican government.

Annex 24 was a system added at the same time, aimed at increasing the traceability of the temporary imports and exports.

About 2 years later, the exemption for triggering Permanent Establishment (PE) was extended an additional 4 years, as long as the company payed income tax in Mexico.

In 2019, Mexico underwent a revolutionary Labor Reform that strengthened a movement supporting the Mexican worker, and aligned Mexico to comply with initiatives central to the upcoming free trade agreement.

2020 - The Modern Shelter Program: A Focused Lense on Compliance

At the turn of the decade, the new USMCA (United States-Mexico-Canada Agreement) was signed and implementation had begun.

Mexico's 2020 Tax Reform required all foreign residents to obtain a tax ID in Mexico, triggering a Permanent Establishment (PE) for virtually all new operations, and despite previous benefits to the Shelter Program. The foreign resident was now subject to an income tax obligation in Mexico at the start of their operations, despite their previous exemption for up to 4 years.

In 2022, Mexico outlawed the option to pay income tax via Advanced Pricing Agreements (APA). Additionally, the Mexican government elongated the VAT Certification and reimbursement processes, and the Authorized Economic Operator (AEO) certification was added, aiming to boost fiscal, customs and security compliance.

WHY PRODENSA?

- Assisting foreign companies in Mexico since 1985

- Offices in all major industrial zones in Mexico

- No hidden fees, full transparency in invoicing

- Strong company culture and retention

- Adaptation to client's business case in Mexico

- Full-spectrum support and integral solutions

- Reputation for ethical execution and compliance

- Participation and leadership in local associations

BROWSE OUR E-BOOKS